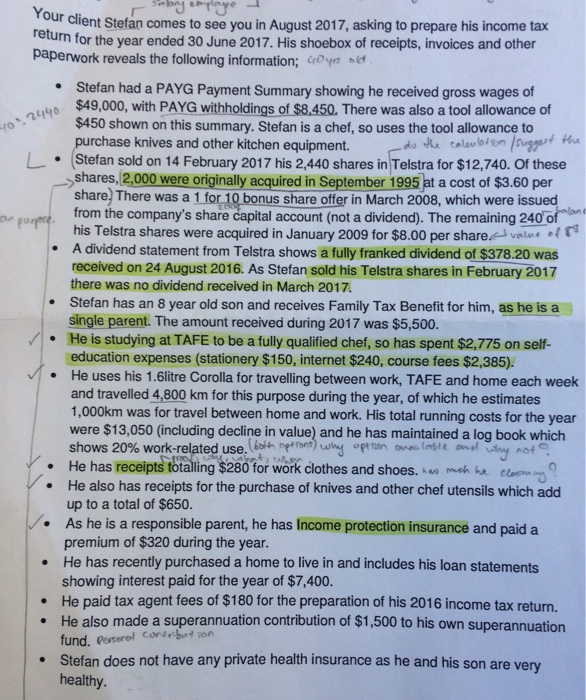

Your client Stefan comes to see you in August 2017, asking to prepare his income tax return for the year ended 30 June 2017. His shoebox of receipts, invoices and other paperwork reveals the following information: Stefan had a PAYG Payment Summary showing he received gross wages of $49, 000, with PAYG withholdings of $8, 450. There was also a tool allowance of $450 shown on this summary. Stefan is a chef, so uses the tool allowance to purchase knives and other kitchen equipment. Stefan sold on 14 February 2017 his 2, 440 shares in Telstra for $12, 740. Of these shares, 2, 000 were originally acquired in September 1995 at a cost of $3.60 per share. There was a 1 for 10 bonus share offer in March 2008, which were issued from the company's share capital account (not a dividend). The remaining 240 of his Telstra shares were acquired in January 2009 for $8.00 per share. A dividend statement from Telstra shows a fully franked dividend of $378.20 was received on 24 August 2016. As Stefan sold his Telstra shares in February 2017 there was no dividend received in March 2017. Stefan has an 8 year old son and receives Family Tax Benefit for him, as he is a single parent. The amount received during 2017 was $5, 500. He is studying at TAFE to be a fully qualified chef, so has spent $2, 775 on self-education expenses (stationery $150, internet $240, course fees $2, 385). He uses his 1.6litre Corolla for travelling between work, TAFE and home each week and travelled 4, 800 km for this purpose during the year, of which he estimates 1, 000km was for travel between home and work. His total running costs for the year were $13, 050 (including decline in value) and he has maintained a log book which shows 20% work-related use. He has receipts totaling $280 for work clothes and shoes. He also has receipts for the purchase of knives and other chef utensils which add up to a total of $650. As he is a responsible parent, he has Income protection insurance and paid a premium of $320 during the year. He has recently purchased a home to live in and includes his loan statements showing interest paid for the year of $7, 400. He paid tax agent fees of $180 for the preparation of his 2016 income tax return. He also made a superannuation contribution of $1, 500 to his own superannuation fund. Stefan does not have any private health insurance as he and his son are very healthy. Your client Stefan comes to see you in August 2017, asking to prepare his income tax return for the year ended 30 June 2017. His shoebox of receipts, invoices and other paperwork reveals the following information: Stefan had a PAYG Payment Summary showing he received gross wages of $49, 000, with PAYG withholdings of $8, 450. There was also a tool allowance of $450 shown on this summary. Stefan is a chef, so uses the tool allowance to purchase knives and other kitchen equipment. Stefan sold on 14 February 2017 his 2, 440 shares in Telstra for $12, 740. Of these shares, 2, 000 were originally acquired in September 1995 at a cost of $3.60 per share. There was a 1 for 10 bonus share offer in March 2008, which were issued from the company's share capital account (not a dividend). The remaining 240 of his Telstra shares were acquired in January 2009 for $8.00 per share. A dividend statement from Telstra shows a fully franked dividend of $378.20 was received on 24 August 2016. As Stefan sold his Telstra shares in February 2017 there was no dividend received in March 2017. Stefan has an 8 year old son and receives Family Tax Benefit for him, as he is a single parent. The amount received during 2017 was $5, 500. He is studying at TAFE to be a fully qualified chef, so has spent $2, 775 on self-education expenses (stationery $150, internet $240, course fees $2, 385). He uses his 1.6litre Corolla for travelling between work, TAFE and home each week and travelled 4, 800 km for this purpose during the year, of which he estimates 1, 000km was for travel between home and work. His total running costs for the year were $13, 050 (including decline in value) and he has maintained a log book which shows 20% work-related use. He has receipts totaling $280 for work clothes and shoes. He also has receipts for the purchase of knives and other chef utensils which add up to a total of $650. As he is a responsible parent, he has Income protection insurance and paid a premium of $320 during the year. He has recently purchased a home to live in and includes his loan statements showing interest paid for the year of $7, 400. He paid tax agent fees of $180 for the preparation of his 2016 income tax return. He also made a superannuation contribution of $1, 500 to his own superannuation fund. Stefan does not have any private health insurance as he and his son are very healthy