Question

Your clients, Mary Eddy and Mack Baker have come to you for help addressing their combined estate plan. Mary, age sixty-eight, is contemplating marriage to

Your clients, Mary Eddy and Mack Baker have come to you for help addressing their combined estate plan. Mary, age sixty-eight, is contemplating marriage to Mack, age thirty-eight. Mack is a handsome man with many attributes that women find appealing. Mary, although an older lady, has maintained her fine figure, occasionally she finds other younger women glancing at Mack. She finds this disconcerting and worries that someday, maybe soon, Mack will leave her for a younger woman.

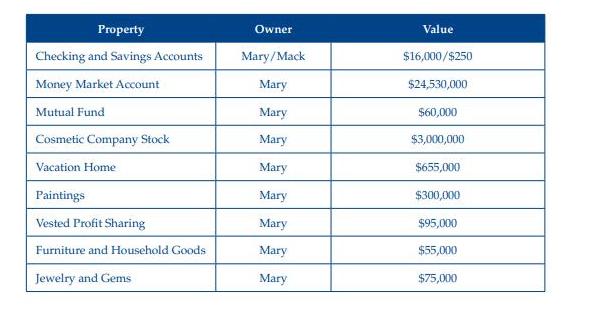

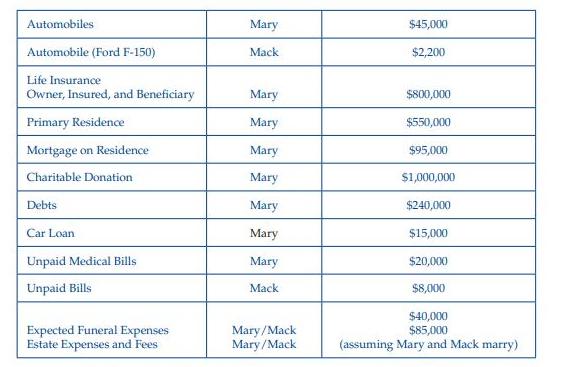

It is unlikely that Mack would ever do such a thing. Besides having professed great love for Mary in his marriage proposal, it is also an established fact that Mack has potentially much to gain from this marriage. Four years ago, he was divorced from his wife after a lengthy bankruptcy filing. Although the bankruptcy filing stopped creditors from harassing him, he has recently received calls from creditors about bills that he is either late on currently or has just failed to pay. He has no children of his own. He currently works as a lawn and supply stocker at a home supply store, where he earns $9.50 per hour. He has no assets other than a 2001 Ford F-150 with 125,000 current miles. Mary is a self-made woman. Five years ago, she sold her cosmetics company that she started in the 1960s with her now-deceased husband. The proceeds of the sale include approximately $24,500,000 in cash and stock in a new cosmetic company worth $3,000,000. She has four grown children and two grandchildren by her first son. Although not a close family, Mary would like for her children to share equally in her estate when she passes. She would also like to leave a legacy for her grandchildren, both living and yet unborn, to pay for college expenses at a private east coast university. If she marries Mack, as she thinks she will, she would like for his needs to be met during his lifetime, unless he has an affair while she is living, regardless of her health or incapacitation, or if he remarries within three years of her death. Mack recently read a book on probate and investing. He has concluded that avoiding probate is a good thing to do. He has suggested that he and Mary place the bulk of their assets in joint tenancy with the right of survivorship. He also wants to have a general power of attorney for Mary beginning at the lesser time of her incapacitation or five years. He has suggested to Mary that she need not have a living will but rather a health care proxy with Mack as the proxy. Mary agrees with Mack that her house should be retitled as joint tenants with the right of survivorship shortly after they are married. She is unsure how this will affect Mack’s relationship with his creditors. This question, along with others, has prompted Mary to seek your advice about what steps she should take next. Please use the following asset and liability data to answer Mary’s questions.

a. Assume Mary and Mack get married. If Mary dies first shortly after marriage, what is the non-inflation adjusted value of her gross estate?

b. Assume Mary dies first and leaves all her assets to Mack. What will be her federal estate tax liability without the marital deduction?

c. Assume Mary dies first and leaves all her assets to Mack. What will be the non-inflation adjusted value of Mack’s gross estate if he dies shortly thereafter?

d. How much will Mack owe in federal estate taxes should Mary dies first, leave all her assets to Mack, with Mack dying shortly thereafter?

e. How does retitling assets as JTWROS conflict with Mary’s family legacy goal?

f. Should Mary add Mack to the title of her home as JTWROS? What would be an alternative recommendation?

g. Why should Mary still have a living will, even though Mack disagrees?

Property Checking and Savings Accounts Money Market Account Mutual Fund Cosmetic Company Stock Vacation Home Paintings Vested Profit Sharing Furniture and Household Goods Jewelry and Gems Owner Mary/Mack Mary Mary Mary Mary Mary Mary Mary Mary Value $16,000/$250 $24,530,000 $60,000 $3,000,000 $655,000 $300,000 $95,000 $55,000 $75,000

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The noninflation adjusted value of Marys gross estate would be 4325000 This includes her checking ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started