Answered step by step

Verified Expert Solution

Question

1 Approved Answer

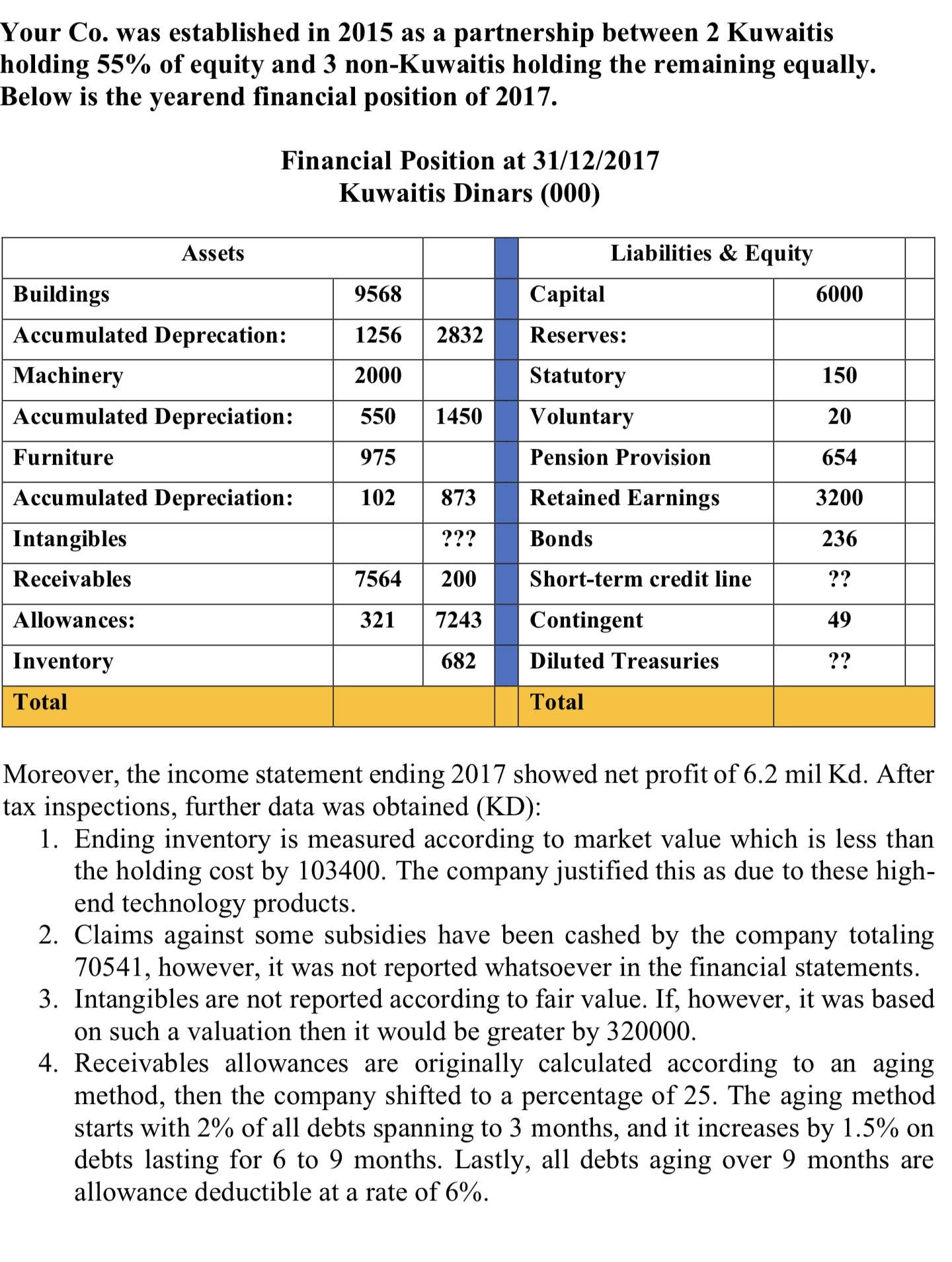

Your Co. was established in 2015 as a partnership between 2 Kuwaitis holding 55% of equity and 3 non-Kuwaitis holding the remaining equally. Below

Your Co. was established in 2015 as a partnership between 2 Kuwaitis holding 55% of equity and 3 non-Kuwaitis holding the remaining equally. Below is the yearend financial position of 2017. Financial Position at 31/12/2017 Kuwaitis Dinars (000) Assets Liabilities & Equity Buildings 9568 Capital 6000 Accumulated Deprecation: Machinery 1256 2832 Reserves: 2000 Statutory 150 Accumulated Depreciation: 550 1450 Voluntary 20 Furniture 975 Pension Provision 654 Accumulated Depreciation: 102 873 Retained Earnings 3200 Intangibles ??? Bonds 236 Receivables 7564 200 Short-term credit line ?? Allowances: 321 7243 Contingent 49 Inventory 682 Diluted Treasuries ?? Total Total Moreover, the income statement ending 2017 showed net profit of 6.2 mil Kd. After tax inspections, further data was obtained (KD): 1. Ending inventory is measured according to market value which is less than the holding cost by 103400. The company justified this as due to these high- end technology products. 2. Claims against some subsidies have been cashed by the company totaling 70541, however, it was not reported whatsoever in the financial statements. 3. Intangibles are not reported according to fair value. If, however, it was based on such a valuation then it would be greater by 320000. 4. Receivables allowances are originally calculated according to an aging method, then the company shifted to a percentage of 25. The aging method. starts with 2% of all debts spanning to 3 months, and it increases by 1.5% on debts lasting for 6 to 9 months. Lastly, all debts aging over 9 months are allowance deductible at a rate of 6%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started