Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company has $3,600,000 in credit sales during 2011. The beginning balance of the allowance for doubtful accounts is $4,900 and the company writes off

Your company has $3,600,000 in credit sales during 2011. The beginning balance of the allowance for doubtful accounts is $4,900 and the company writes off 700 in bad debts during the year.

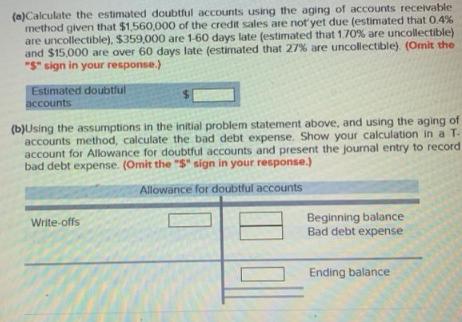

(a)Calculate the estimated doubtful accounts using the aging of accounts receivable method given that $1,560,000 of the credit sales are not yet due (estimated that0.4% are uncollectible), $359,000 are 1-60 days late (estimated that 1.70% are uncollectible) and $15,000 are over 60 days late (estimated that 27% are uncollectible). (Omit the "S" sign in your response.) Estimated doubtful accounts (b)Using the assumptions in the initial problem statement above, and using the aging of accounts method, calculate the bad debt expense. Show your calculation in a T. account for Allowance for doubtful accounts and present the journal entry to record bad debt expense. (Omit the "$". sign in your response.) Allowance for doubtful accounts Beginning balance Bad debt expense Write-offs Ending balance

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cin Nov working Microsoft Excel Home Insert Page Layout Formulas Data Review View Cut E AutoS...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started