Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company has asked you to do preliminary analysis on a new four year project. The project would increase projected sales by $120,000 each

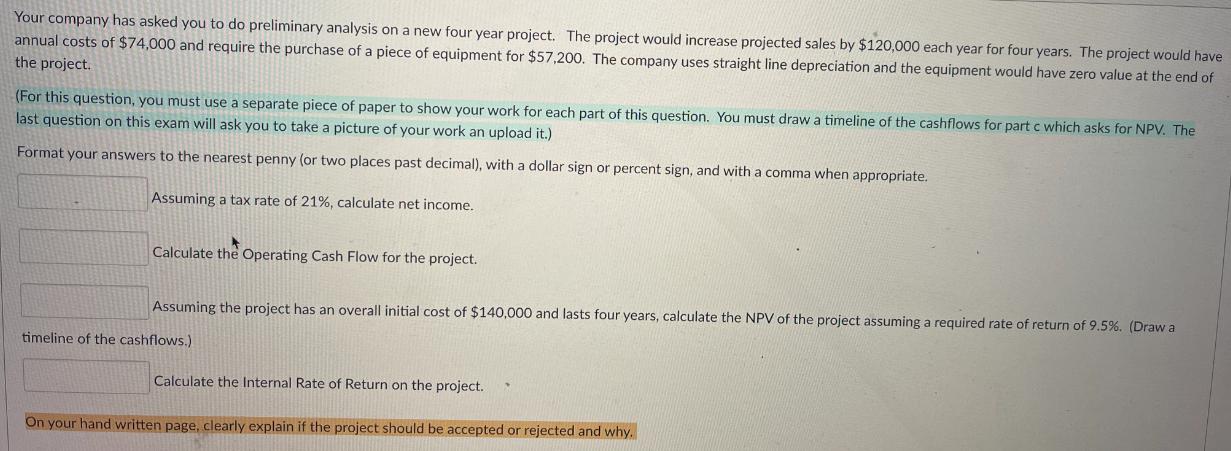

Your company has asked you to do preliminary analysis on a new four year project. The project would increase projected sales by $120,000 each year for four years. The project would have annual costs of $74,000 and require the purchase of a piece of equipment for $57,200. The company uses straight line depreciation and the equipment would have zero value at the end of the project. (For this question, you must use a separate piece of paper to show your work for each part of this question. You must draw a timeline of the cashflows for part c which asks for NPV. The last question on this exam will ask you to take a picture of your work an upload it.) Format your answers to the nearest penny (or two places past decimal), with a dollar sign or percent sign, and with a comma when appropriate. Assuming a tax rate of 21%, calculate net income. Calculate the Operating Cash Flow for the project. Assuming the project has an overall initial cost of $140,000 and lasts four years, calculate the NPV of the project assuming a required rate of return of 9.5%. (Draw a timeline of the cashflows.) Calculate the Internal Rate of Return on the project. . On your hand written page, clearly explain if the project should be accepted or rejected and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down each part of the question a Calculate net income Net Income Sales Revenue Costs Depr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started