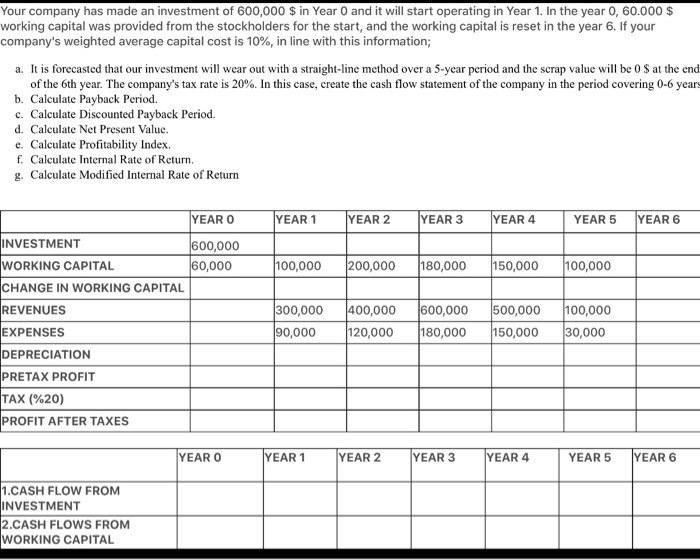

Your company has made an investment of 600,000 $ in Year 0 and it will start operating in Year 1. In the year 0,60.000 $ working capital was provided from the stockholders for the start, and the working capital is reset in the year 6. If your company's weighted average capital cost is 10%, in line with this information; a. It is forecasted that our investment will wear out with a straight-line method over a 5-year period and the scrap value will be 0 $ at the end of the 6th year. The company's tax rate is 20%. In this case, create the cash flow statement of the company in the period covering 0-6 years b. Calculate Payback Period. c. Calculate Discounted Payback Period. d. Calculate Net Present Value. e. Calculate Profitability Index. f. Calculate Internal Rate of Return. g. Calculate Modified Internal Rate of Return YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 100,000 200,000 180,000 150,000 100,000 YEAR O INVESTMENT 600,000 WORKING CAPITAL 60,000 CHANGE IN WORKING CAPITAL REVENUES EXPENSES DEPRECIATION PRETAX PROFIT TAX (%20) PROFIT AFTER TAXES 300,000 90,000 400,000 120,000 600,000 180,000 500,000 150,000 100,000 30,000 YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 1.CASH FLOW FROM INVESTMENT 2.CASH FLOWS FROM WORKING CAPITAL Your company has made an investment of 600,000 $ in Year 0 and it will start operating in Year 1. In the year 0,60.000 $ working capital was provided from the stockholders for the start, and the working capital is reset in the year 6. If your company's weighted average capital cost is 10%, in line with this information; a. It is forecasted that our investment will wear out with a straight-line method over a 5-year period and the scrap value will be 0 $ at the end of the 6th year. The company's tax rate is 20%. In this case, create the cash flow statement of the company in the period covering 0-6 years b. Calculate Payback Period. c. Calculate Discounted Payback Period. d. Calculate Net Present Value. e. Calculate Profitability Index. f. Calculate Internal Rate of Return. g. Calculate Modified Internal Rate of Return YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 100,000 200,000 180,000 150,000 100,000 YEAR O INVESTMENT 600,000 WORKING CAPITAL 60,000 CHANGE IN WORKING CAPITAL REVENUES EXPENSES DEPRECIATION PRETAX PROFIT TAX (%20) PROFIT AFTER TAXES 300,000 90,000 400,000 120,000 600,000 180,000 500,000 150,000 100,000 30,000 YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 1.CASH FLOW FROM INVESTMENT 2.CASH FLOWS FROM WORKING CAPITAL