Answered step by step

Verified Expert Solution

Question

1 Approved Answer

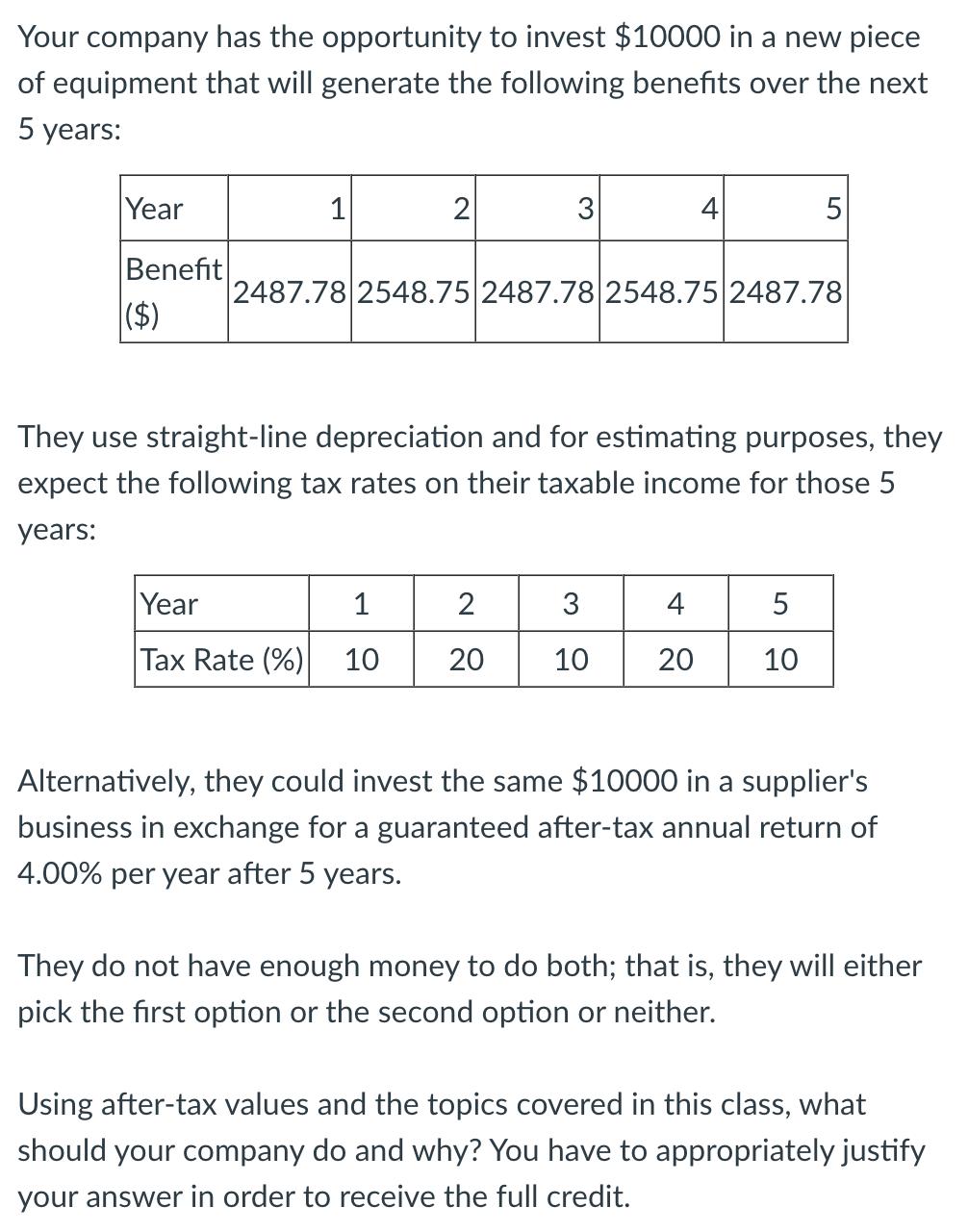

Your company has the opportunity to invest $10000 in a new piece of equipment that will generate the following benefits over the next 5

Your company has the opportunity to invest $10000 in a new piece of equipment that will generate the following benefits over the next 5 years: Year Benefit ($) 1 Year Tax Rate (%) 2 1 10 3 2487.78 2548.75 2487.78 2548.75 2487.78 They use straight-line depreciation and for estimating purposes, they expect the following tax rates on their taxable income for those 5 years: 2 20 4 3 4 10 20 5 5 10 Alternatively, they could invest the same $10000 in a supplier's business in exchange for a guaranteed after-tax annual return of 4.00% per year after 5 years. They do not have enough money to do both; that is, they will either pick the first option or the second option or neither. Using after-tax values and the topics covered in this class, what should your company do and why? You have to appropriately justify your answer in order to receive the full credit.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The company should choose to invest in the suppliers business in exchange for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started