Question

Your company has to buy a new copy machine. Toshiba costs$6,000 to buy and it costs $ 3,000 annually to operate. This machine will have

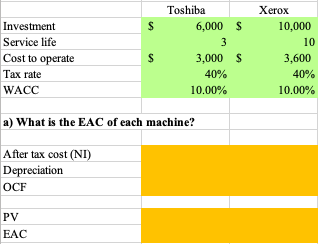

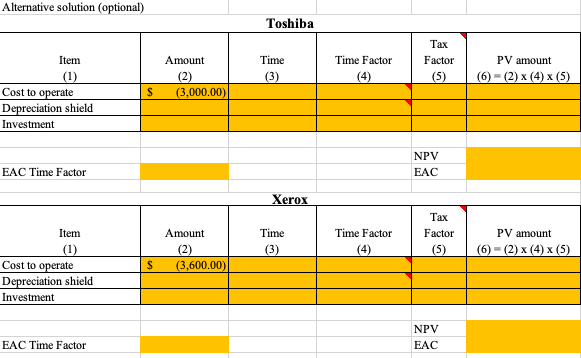

Your company has to buy a new copy machine. Toshiba costs$6,000 to buy and it costs $ 3,000 annually to operate. This machine will have 3 years of a service life, over which it will depreciate to zero salvage value (straight line depreciation will be used). Xerox costs $ 10,000 to buy and $3,600 annually to operate, and it will have 10 years of service life. Xerox will also be depreciated to zero over its service life using straight line depreciation. The company tax rate is 40% and its WACC is 12%.

a) What is the EAC of each machine? Use any preferred method to find it

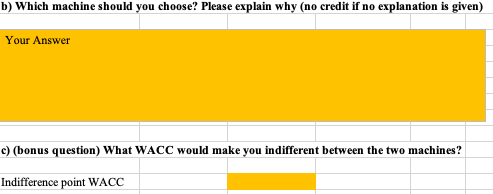

b) Which machine should you choose? Please explain why (no credit if no explanation is given)

c) (bonus question) What WACC would make you indifferent between the two machines?

Investment Service life Cost to operate Tax rate WACC $ PV EAC $ Toshiba 6,000 $ 3 3,000 $ 40% 10.00% a) What is the EAC of each machine? After tax cost (NI) Depreciation OCF Xerox 10,000 10 3,600 40% 10.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the Equivalent Annual Cost EAC of each machine we need to consider both the initial cost and the annual operating costs For the Toshiba ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started