Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company is considering the purchase of the Bluffs at West Rim, a 300 Unit, senior-oriented luxury apartment complex in Austin. There are 75

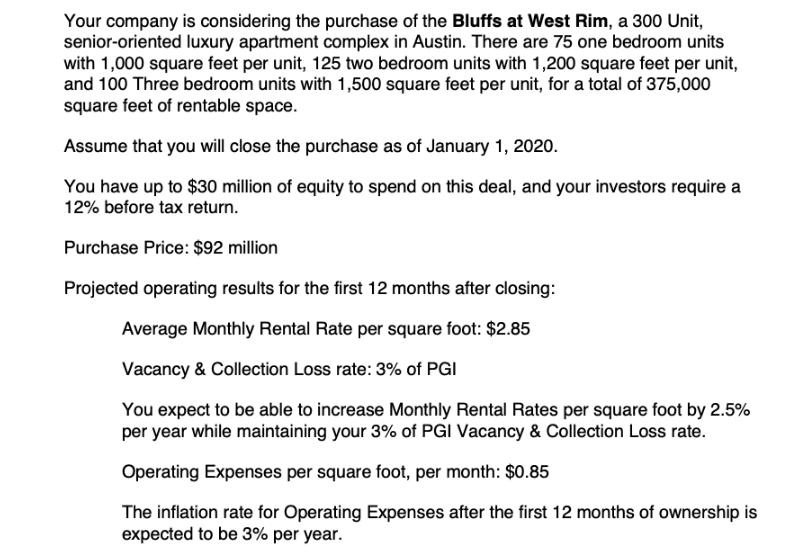

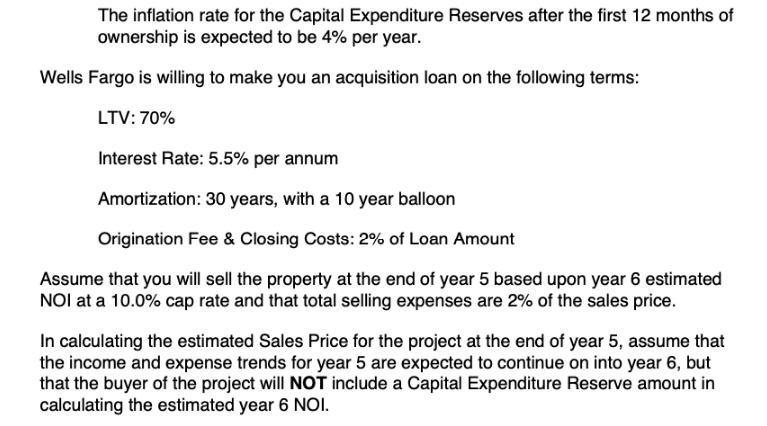

Your company is considering the purchase of the Bluffs at West Rim, a 300 Unit, senior-oriented luxury apartment complex in Austin. There are 75 one bedroom units with 1,000 square feet per unit, 125 two bedroom units with 1,200 square feet per unit, and 100 Three bedroom units with 1,500 square feet per unit, for a total of 375,000 square feet of rentable space. Assume that you will close the purchase as of January 1, 2020. You have up to $30 million of equity to spend on this deal, and your investors require a 12% before tax return. Purchase Price: $92 million Projected operating results for the first 12 months after closing: Average Monthly Rental Rate per square foot: $2.85 Vacancy & Collection Loss rate: 3% of PGI You expect to be able to increase Monthly Rental Rates per square foot by 2.5% per year while maintaining your 3% of PGI Vacancy & Collection Loss rate. Operating Expenses per square foot, per month: $0.85 The inflation rate for Operating Expenses after the first 12 months of ownership is expected to be 3% per year. Capital Expenditure Reserves per square foot, per month: $0.09 The inflation rate for the Capital Expenditure Reserves after the first 12 months of ownership is expected to be 4% per year. Wells Fargo is willing to make you an acquisition loan on the following terms: LTV: 70% Interest Rate: 5.5% per annum Amortization: 30 years, with a 10 year balloon Origination Fee & Closing Costs: 2% of Loan Amount Assume that you will sell the property at the end of year 5 based upon year 6 estimated NOI at a 10.0% cap rate and that total selling expenses are 2% of the sales price. In calculating the estimated Sales Price for the project at the end of year 5, assume that the income and expense trends for year 5 are expected to continue on into year 6, but that the buyer of the project will NOT include a Capital Expenditure Reserve amount in calculating the estimated year 6 NOI. What is the indicated net present value of the investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Bluffs at West Rim Acquisition Analysis Based on the information provided heres an analysis of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started