Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company is considering the replacement of one of your assembly line robots. Both the new and the old robot would last another 5

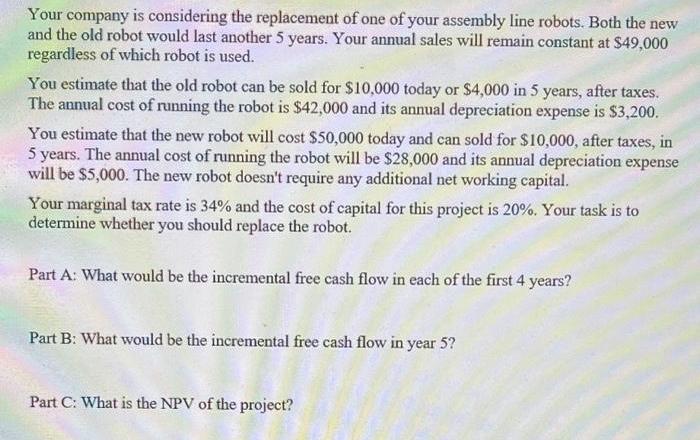

Your company is considering the replacement of one of your assembly line robots. Both the new and the old robot would last another 5 years. Your annual sales will remain constant at $49,000 regardless of which robot is used. You estimate that the old robot can be sold for $10,000 today or $4,000 in 5 years, after taxes. The annual cost of running the robot is $42,000 and its annual depreciation expense is $3,200. You estimate that the new robot will cost $50,000 today and can sold for $10,000, after taxes, in 5 years. The annual cost of running the robot will be $28,000 and its annual depreciation expense will be $5,000. The new robot doesn't require any additional net working capital. Your marginal tax rate is 34% and the cost of capital for this project is 20%. Your task is to determine whether you should replace the robot. Part A: What would be the incremental free cash flow in each of the first 4 years? Part B: What would be the incremental free cash flow in year 5? Part C: What is the NPV of the project?

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Part A To determine the incremental free cash flow in each of the first 4 years we need to calculate the cash inflows and outflows associated with each robot option For the old robot Annual cash inflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started