Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company is currently paying an outside firm $240,000 per year to manufacture products for your company. You sell the products for $350,000 each

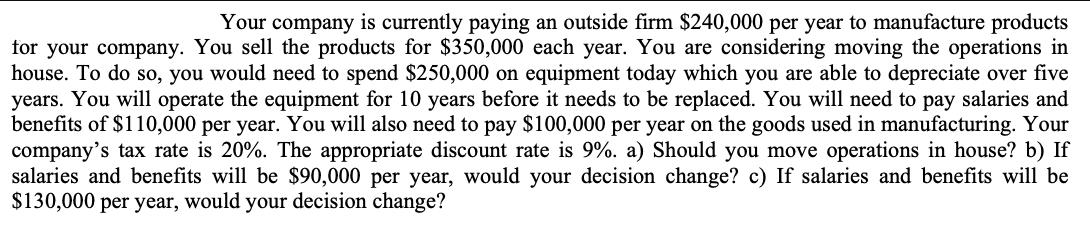

Your company is currently paying an outside firm $240,000 per year to manufacture products for your company. You sell the products for $350,000 each year. You are considering moving the operations in house. To do so, you would need to spend $250,000 on equipment today which you are able to depreciate over five years. You will operate the equipment for 10 years before it needs to be replaced. You will need to pay salaries and benefits of $110,000 per year. You will also need to pay $100,000 per year on the goods used in manufacturing. Your company's tax rate is 20%. The appropriate discount rate is 9%. a) Should you move operations in house? b) If salaries and benefits will be $90,000 per year, would your decision change? c) If salaries and benefits will be $130,000 per year, would your decision change?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Determine whether I should move operations inhouse Given Initial equipment cost 250000 depreciated over five years Operating costs including salaries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started