Answered step by step

Verified Expert Solution

Question

1 Approved Answer

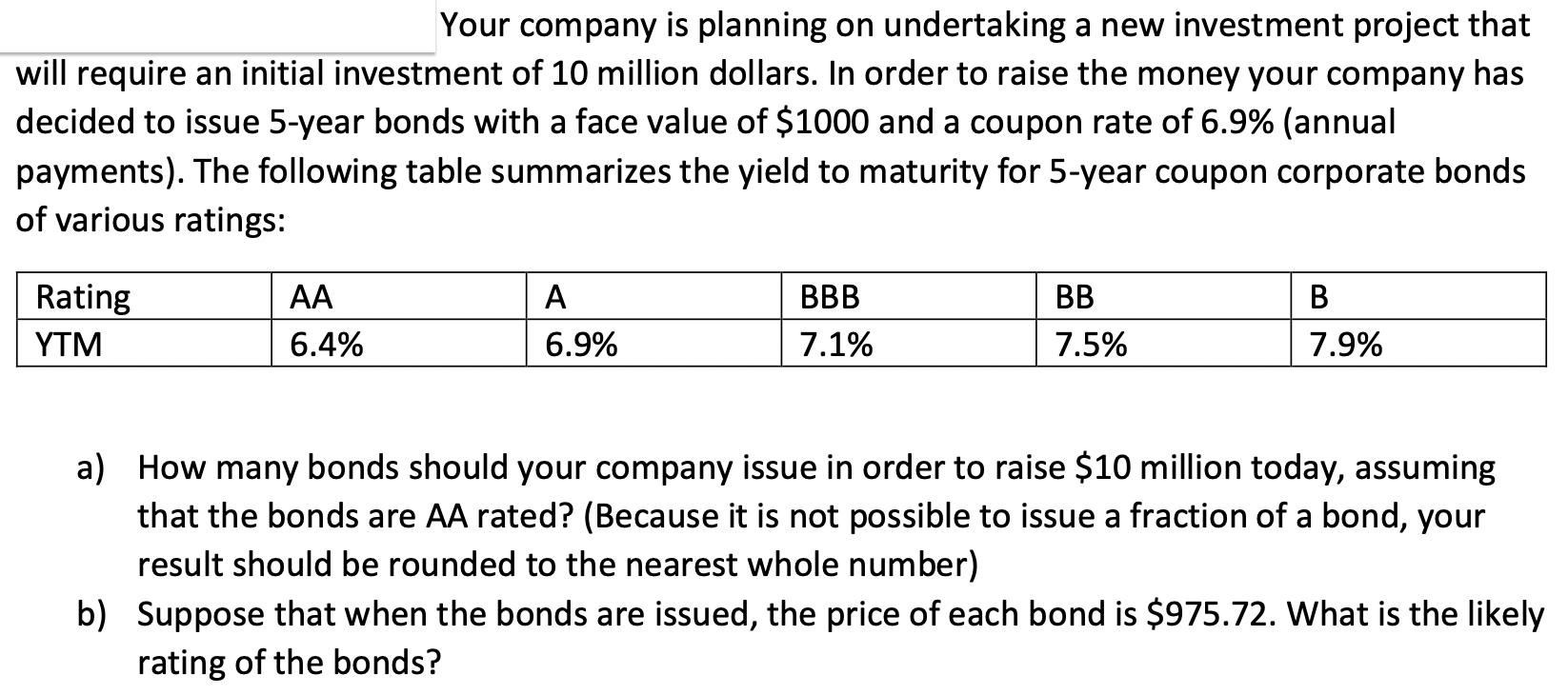

Your company is planning on undertaking a new investment project that will require an initial investment of 10 million dollars. In order to raise

Your company is planning on undertaking a new investment project that will require an initial investment of 10 million dollars. In order to raise the money your company has decided to issue 5-year bonds with a face value of $1000 and a coupon rate of 6.9% (annual payments). The following table summarizes the yield to maturity for 5-year coupon corporate bonds of various ratings: Rating YTM AA 6.4% A 6.9% BBB 7.1% BB 7.5% B 7.9% a) How many bonds should your company issue in order to raise $10 million today, assuming that the bonds are AA rated? (Because it is not possible to issue a fraction of a bond, your result should be rounded to the nearest whole number) b) Suppose that when the bonds are issued, the price of each bond is $975.72. What is the likely rating of the bonds?

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the number of bonds your company needs to issue to raise 10 million today assuming th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started