Your company is planning to expand its existing business to meet projected increases in demand for...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

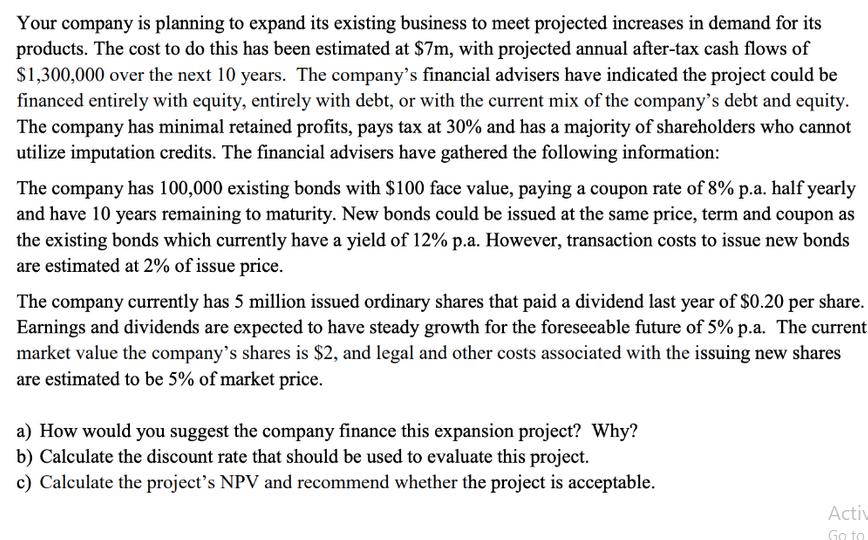

Your company is planning to expand its existing business to meet projected increases in demand for its products. The cost to do this has been estimated at $7m, with projected annual after-tax cash flows of $1,300,000 over the next 10 years. The company's financial advisers have indicated the project could be financed entirely with equity, entirely with debt, or with the current mix of the company's debt and equity. The company has minimal retained profits, pays tax at 30% and has a majority of shareholders who cannot utilize imputation credits. The financial advisers have gathered the following information: The company has 100,000 existing bonds with $100 face value, paying a coupon rate of 8% p.a. half yearly and have 10 years remaining to maturity. New bonds could be issued at the same price, term and coupon as the existing bonds which currently have a yield of 12% p.a. However, transaction costs to issue new bonds are estimated at 2% of issue price. The company currently has 5 million issued ordinary shares that paid a dividend last year of $0.20 per share. Earnings and dividends are expected to have steady growth for the foreseeable future of 5% p.a. The current market value the company's shares is $2, and legal and other costs associated with the issuing new shares are estimated to be 5% of market price. a) How would you suggest the company finance this expansion project? Why? b) Calculate the discount rate that should be used to evaluate this project. c) Calculate the project's NPV and recommend whether the project is acceptable. Activ Go to Your company is planning to expand its existing business to meet projected increases in demand for its products. The cost to do this has been estimated at $7m, with projected annual after-tax cash flows of $1,300,000 over the next 10 years. The company's financial advisers have indicated the project could be financed entirely with equity, entirely with debt, or with the current mix of the company's debt and equity. The company has minimal retained profits, pays tax at 30% and has a majority of shareholders who cannot utilize imputation credits. The financial advisers have gathered the following information: The company has 100,000 existing bonds with $100 face value, paying a coupon rate of 8% p.a. half yearly and have 10 years remaining to maturity. New bonds could be issued at the same price, term and coupon as the existing bonds which currently have a yield of 12% p.a. However, transaction costs to issue new bonds are estimated at 2% of issue price. The company currently has 5 million issued ordinary shares that paid a dividend last year of $0.20 per share. Earnings and dividends are expected to have steady growth for the foreseeable future of 5% p.a. The current market value the company's shares is $2, and legal and other costs associated with the issuing new shares are estimated to be 5% of market price. a) How would you suggest the company finance this expansion project? Why? b) Calculate the discount rate that should be used to evaluate this project. c) Calculate the project's NPV and recommend whether the project is acceptable. Activ Go to

Expert Answer:

Answer rating: 100% (QA)

a In determining how the company should finance the expansion project it is important to consider the cost of capital associated with each financing o... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

BigDeal Real Estate surveyed prices per square foot in the valley and foothills of Hoke-a-mo, Utah. Based on BD's DATA, are prices per square foot equal at = 0.01? The critical value is 2.977 since...

-

respond to the instruction using the following criteria: Individual Written Case Exercise Respond to the specific questions provide in the case document it will be seven documents. Please make sure...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Following are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount. COUNTRY KETTLES,...

-

Consider an infinitely long wire coinciding with the positive x-axis and having mass density ((x) = (1 + x2)-1, 0 ( x < (. (a) Calculate the total mass of the wire? (b) Show that the wire does not...

-

There are 17 components of the Justice Model. After reading von Hirsh's Doing Justice and the 17 components of the Justice Model in the article "The Just4icde Model" what specific aspect of the model...

-

2. CPA QUESTION On July 1, 1992, Quick, Onyx, and Nash were deeded a piece of land as tenants in common. The deed provided that Quick owned half the property and Onyx and Nash owned one quarter each....

-

Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%. Dec. 1 Received payment on account from Michael Anderson, $1,360. 2 Received payment...

-

Just after it's formation on September 1, 2019, the ledger account of the Ducks inc. contained the following balance: accrued expenses payable $4000 accont payable 7000 accoungs receivable 53000...

-

Wilson Vistas is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single...

-

What is a way Oracle database authenticates users before allowing a database session to be created?

-

The radio telescopes at Amherst, Massachusetts, and Onsala, Sweden, are used as an interferometer, the baseline being 2900 km. a) What is the resolution at 22 GHz in the direction of the baseline? b)...

-

How many networks (subnets) are required for the about network diagram? The answer must indicate pairs of network such as A - R1. Network A 50 hosts Network B 60 hosts eth1 R1 eth2 eth1 eth2 R3 eth1...

-

Lab 2 One of the most well-known packet sniffers is called Wireshark (formerly named Ethereal). It is a powerful tool that can capture, filter, and analyze network traffic. It can promiscuously...

-

You are given a string letters made of N English letters. Count the number of different letters that appear in both uppercase and lowercase where all lowercase occurrences of the given letter appear...

-

Bald Bakers sweet challenge Case analysis a)Clearly identify the major strategic issue facing the company. Remember to focus on marketing strategy and not the immediate short-term problems....

-

f. Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income. Use a negative sign with your answer to indicate a reduction to net income....

-

Solve each equation. x 3 - 6x 2 = -8x

-

What is the future worth of a series of equal year-end deposits of $2,000 for 15 years in a savings account that earns 8% annual interest if the following were true? (a) All deposits are made at the...

-

You are considering constructing a luxury apartment building project that requires an investment of $ 15,500,000, which comprises $ 12,000,000 for the building and $3,500,000 for land. The building...

-

Consider the two mutually exclusive investment projects given in Table P7.57. TABLE P7.57 (a) To use the IRR criterion, what assumption must be made in comparing a set of mutually exclusive...

-

Which of the following assertions concerning the interpretive publications is inaccurate: (a) Interpretive publications consist of auditing Interpretations of the SASs, appendixes to the SASs,...

-

Which of the following, is not an element of an assurance engagement? (a) A three-party relationship involving a practitioner, a responsible party, and intended users (b) An oral or written assurance...

-

Which of the following characteristics exhibit Suitable criteria under the assurance engagement? (a) Relevance; (b) Completeness; (c) Reliability; (d) Neutrality (e) Understandability (f) All of the...

Study smarter with the SolutionInn App