Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company just bought a new piece of automotive manufacturing equipment (asset class 13.3), which will be depreciated under MACRS (GDS) with a recovery period

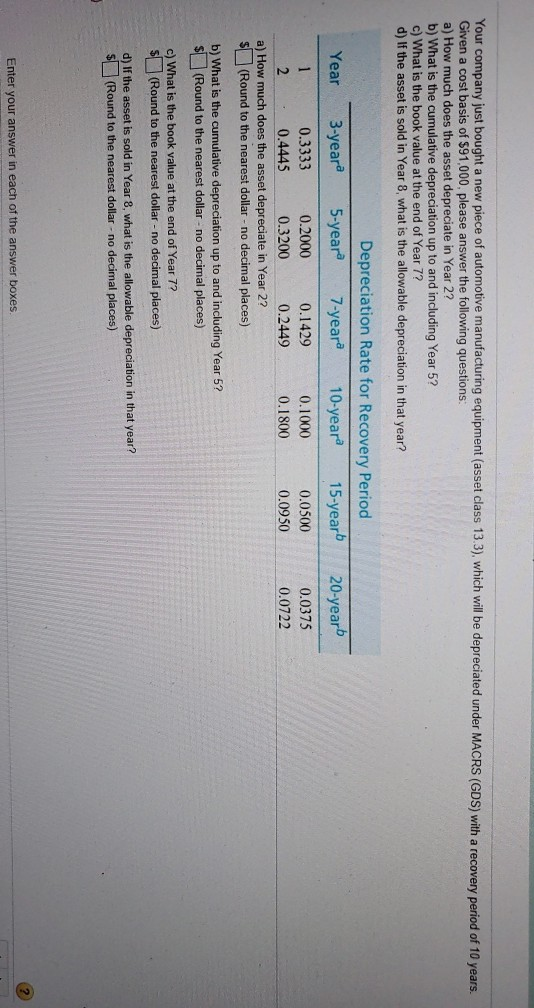

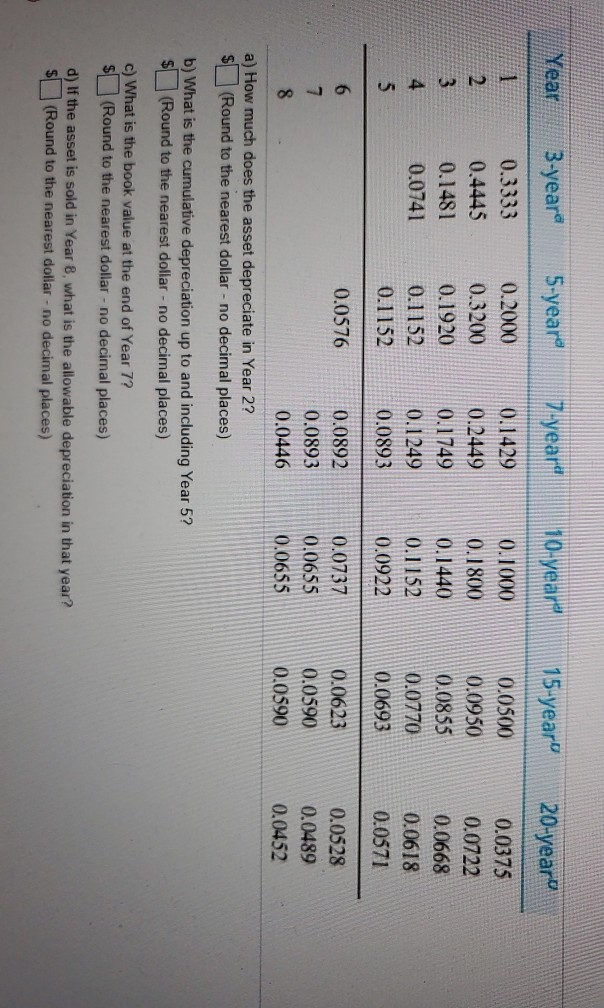

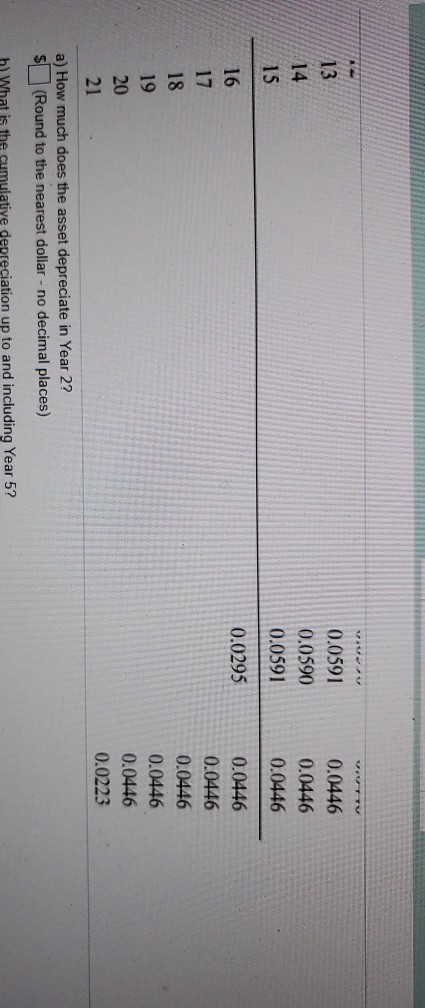

Your company just bought a new piece of automotive manufacturing equipment (asset class 13.3), which will be depreciated under MACRS (GDS) with a recovery period of 10 years. Given a cost basis of $91,000, please answer the following questions: a) How much does the asset depreciate in Year 2? b) What is the cumulative depreciation up to and including Year 5? c) What is the book value at the end of Year 7? d) If the asset is sold in Year 8, what is the allowable depreciation in that year? 20-year Depreciation Rate for Recovery Period Year 3-year 5-year 7-yeara 10-yeara 15-year 1 0.3333 0.2000 0.1429 0.1000 0.0500 2 0 .44450.3200 0.2449 0.18000 .0950 a) How much does the asset depreciate in Year 2? $ (Round to the nearest dollar - no decimal places) 0.0375 0.0722 b) What is the cumulative depreciation up to and including Year 5? $ (Round to the nearest dollar - no decimal places) c) What is the book value at the end of Year 7? $ (Round to the nearest dollar - no decimal places) d) If the asset is sold in Year 8, what is the allowable depreciation in that year? $ (Round to the nearest dollar - no decimal places) Enter your answer in each of the answer boxes. YearB-year 0.3333 0.4445 0.1481 0.0741 5-year 0.2000 0.3200 0.1920 0.1152 0.1152 2year 0.1429 0.2449 0.1749 0.1249 0.0893 10-year 0.1000 0.1800 0.1440 0.1152 0.0922 75-year 0.0500 0.0950 0.0855 0.0770 0.0693 20-yearu 0.0375 0.0722 0.0668 0.0618 0.0571 0.0576 0.0892 0.0893 0.0446 a) How much does the asset depreciate in Year 2? $ (Round to the nearest dollar - no decimal places) 0.0737 0.0655 0.0655 0.0623 0.0590 0.0590 0.0528 0.0489 b) What is the cumulative depreciation up to and including Year 5? $ (Round to the nearest dollar - no decimal places) c) What is the book value at the end of Year 7? $ (Round to the nearest dollar-no decimal places) d) If the asset is sold in Year 8, what is the allowable depreciation in that year? $ (Round to the nearest dollar - no decimal places) VITTU viver 0.0591 0.0590 0.0591 0.0446 0.0446 0.0446 0.0295 16 17 18 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 a) How much does the asset depreciate in Year 2? $ (Round to the nearest dollar - no decimal places) h) What is the cumulative depreciation up to and including Year 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started