Question

Your company must obtain some laser measurement devices for the next six years and is considering leasing. You have been directed to perform an actual-dollar

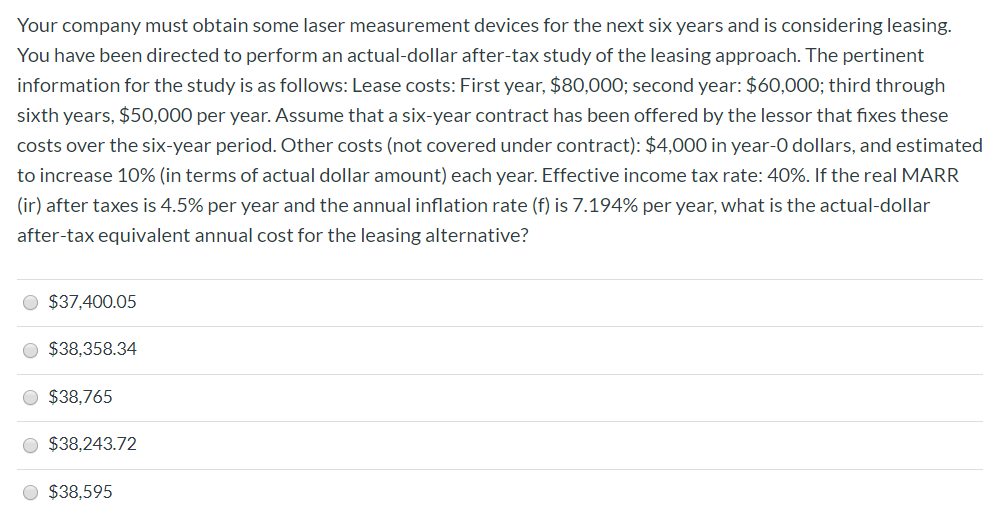

Your company must obtain some laser measurement devices for the next six years and is considering leasing. You have been directed to perform an actual-dollar after-tax study of the leasing approach. The pertinent information for the study is as follows: Lease costs: First year, $80,000; second year: $60,000; third through sixth years, $50,000 per year. Assume that a six-year contract has been offered by the lessor that fixes these costs over the six-year period. Other costs (not covered under contract): $4,000 in year-0 dollars, and estimated to increase 10% (in terms of actual dollar amount) each year. Effective income tax rate: 40%. If the real MARR (ir) after taxes is 4.5% per year and the annual inflation rate (f) is 7.194% per year, what is the actual-dollar after-tax equivalent annual cost for the leasing alternative?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started