Question

Your company operates 20 construction machines which need to be replaced. After an extensive selection process, there are two technically viable options remaining: One with

Your company operates 20 construction machines which need to be replaced. After an extensive selection process, there are two technically viable options remaining: One with a diesel engine and one with a hybrid power unit.

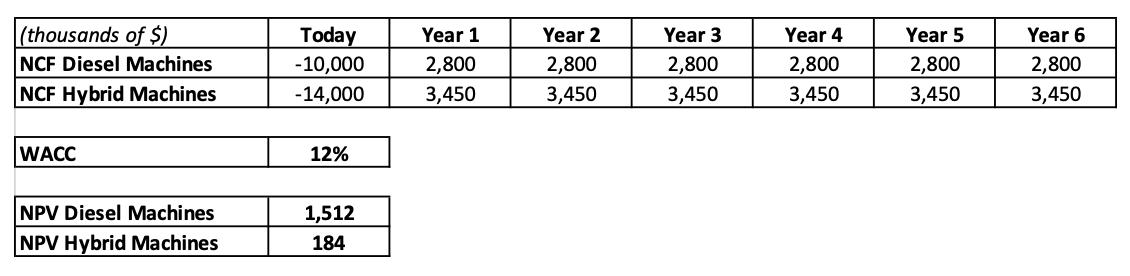

Your assistant has compiled a standard DCF-analysis for the two alternatives, which is shown below. Accordingly, the overall NPV of the project "Buy 20 Diesel Machines" is roughly $1.5 million whereas the NPV of the project "Buy 20 Hybrid Machines" is roughly $0.2 million:

You have full confidence that your assistant's analyes are correct. However, you also know that these analyses exclude any environmental effects. In particular, you know that the diesel engines will have significantly higher carbon emissions than the hybrid power units. Specifically, you assume that a diesel fleet would have approximately 4,000 tons of carbon emissions per year whereas the emissions of the hybrid fleet would only be approximately 1,000 tons per year. While carbon emissions have no binding market price, you believe that the social costs of a ton of carbon emissions can be as high as $80. You also know that your shareholders care about ESG factors.

Based on all this information, what is your recommendation?

(thousands of $) NCF Diesel Machines NCF Hybrid Machines WACC NPV Diesel Machines NPV Hybrid Machines Today -10,000 -14,000 12% 1,512 184 Year 1 2,800 3,450 Year 2 2,800 3,450 Year 3 2,800 3,450 Year 4 2,800 3,450 Year 5 2,800 3,450 Year 6 2,800 3,450

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Given the additional information about the environmental impact of the two alternatives it is import...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started