Question

Your company plans to expand its operation rather than outsourcing delivery service to the customers. The company is considering delivery itself. The company has

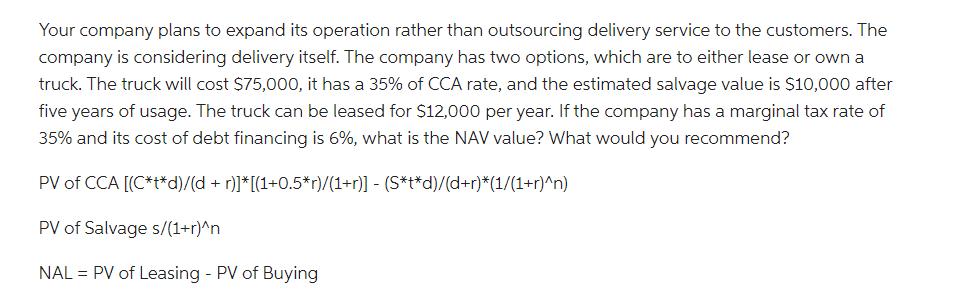

Your company plans to expand its operation rather than outsourcing delivery service to the customers. The company is considering delivery itself. The company has two options, which are to either lease or own a truck. The truck will cost $75,000, it has a 35% of CCA rate, and the estimated salvage value is $10,000 after five years of usage. The truck can be leased for $12,000 per year. If the company has a marginal tax rate of 35% and its cost of debt financing is 6%, what is the NAV value? What would you recommend? PV of CCA [(C*t*d)/(d + r)]*[(1+0.5*r)/(1+r)] - (S*t*d)/(d+r)*(1/(1+r)^n) PV of Salvage s/(1+r)^n NAL = PV of Leasing - PV of Buying

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

NAL 12000035006006006 75000035006006006110065 10000035...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information For Decisions

Authors: Robert w Ingram, Thomas L Albright

6th Edition

9780324313413, 324672705, 324313411, 978-0324672701

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App