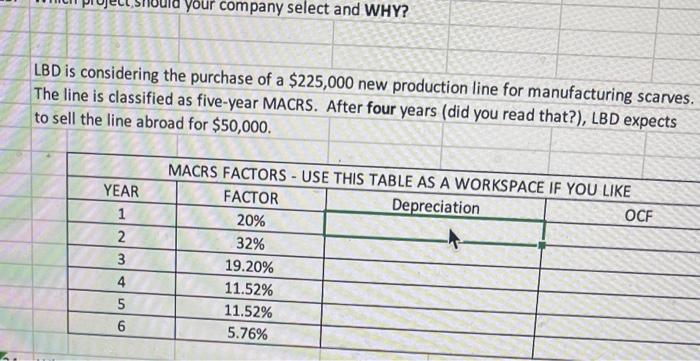

Question: your company select and WHY? LBD is considering the purchase of a $225,000 new production line for manufacturing scarves. The line is classified as five-year

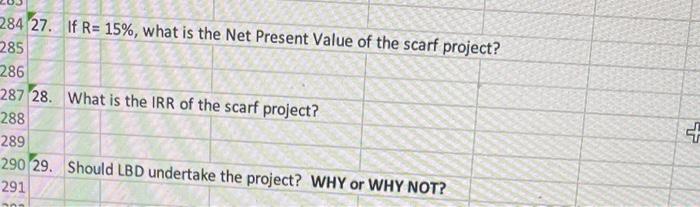

your company select and WHY? LBD is considering the purchase of a $225,000 new production line for manufacturing scarves. The line is classified as five-year MACRS. After four years (did you read that?), LBD expects to sell the line abroad for $50,000. YEAR 1 2 3 4 5 6 MACRS FACTORS - USE THIS TABLE AS A WORKSPACE IF YOU LIKE FACTOR Depreciation OCF 20% 32% 19.20% 11.52% 11.52% 5.76% 284 27. If R= 15%, what is the Net Present Value of the scarf project? 285 286 287 28. What is the IRR of the scarf project? 288 289 290 29. Should LBD undertake the project? WHY or WHY NOT? 291 your company select and WHY? LBD is considering the purchase of a $225,000 new production line for manufacturing scarves. The line is classified as five-year MACRS. After four years (did you read that?), LBD expects to sell the line abroad for $50,000. YEAR 1 2 3 4 5 6 MACRS FACTORS - USE THIS TABLE AS A WORKSPACE IF YOU LIKE FACTOR Depreciation OCF 20% 32% 19.20% 11.52% 11.52% 5.76% 284 27. If R= 15%, what is the Net Present Value of the scarf project? 285 286 287 28. What is the IRR of the scarf project? 288 289 290 29. Should LBD undertake the project? WHY or WHY NOT? 291

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts