Question

Your company wants to invest its cash surplus of $1m. in a Treasury bill for a period of 6 months. The T-bill rate is

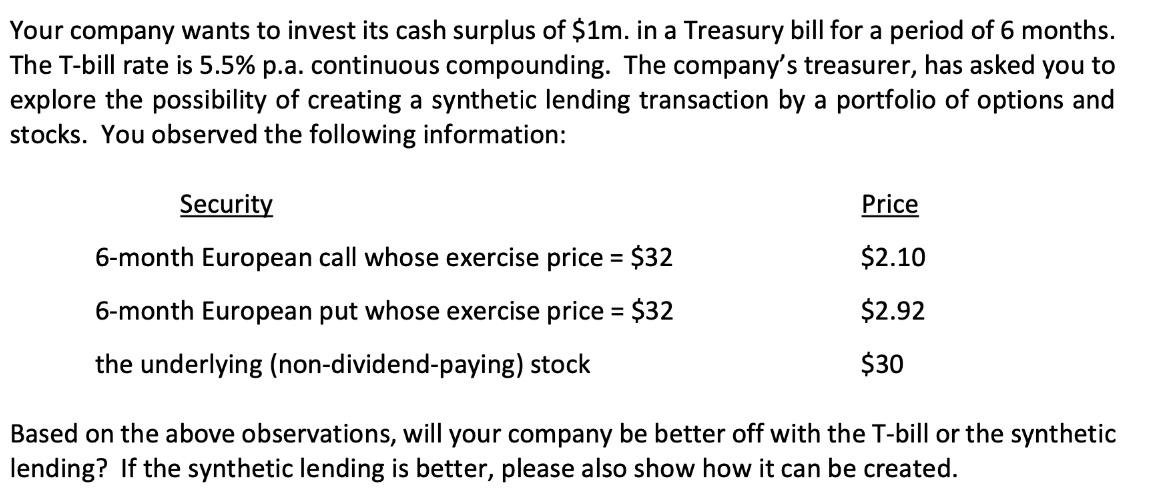

Your company wants to invest its cash surplus of $1m. in a Treasury bill for a period of 6 months. The T-bill rate is 5.5% p.a. continuous compounding. The company's treasurer, has asked you to explore the possibility of creating a synthetic lending transaction by a portfolio of options and stocks. You observed the following information: Security 6-month European call whose exercise price = $32 6-month European put whose exercise price = $32 the underlying (non-dividend-paying) stock Price $2.10 $2.92 $30 Based on the above observations, will your company be better off with the T-bill or the synthetic lending? If the synthetic lending is better, please also show how it can be created.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Information Systems

Authors: Ralph M. Stair, George W. Reynolds

9th edition

978-1337097536, 1337097535, 978-1337515634, 1337515639, 978-0324665284

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App