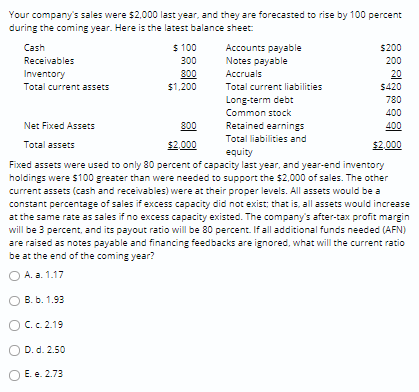

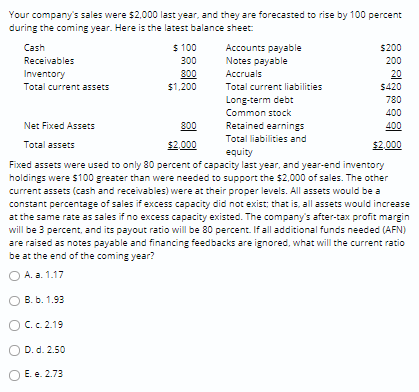

Your company's sales were $2,000 last year, and they are forecasted to rise by 100 percent during the coming year. Here is the latest balance sheet: Cash $ 100 Accounts payable S200 Receivables 300 Notes payable 200 Inventory 800 Accruals 20 Total current assets $1,200 Total current liabilities 5420 Long-term debt 780 Common stock 400 Net Fixed Assets 800 Retained earnings 400 Total assets $2.000 Total liabilities and equity $2.000 Fixed assets were used to only 30 percent of capacity last year, and year-end inventory holdings were $100 greater than were needed to support the $2,000 of sales. The other current assets (cash and receivables) were at their proper levels. All assets would be a constant percentage of sales if excess capacity did not exist that is all assets would increase at the same rate as sales if no excess capacity existed. The company's after-tax profit margin will be 3 percent, and its payout ratio will be 80 percent. If all additional funds needed (AFN) are raised as notes payable and financing feedbacks are ignored, what will the current ratio be at the end of the coming year? A. a. 1.17 B. b. 1.93 C.C2.19 D. d. 2.50 E. e. 2.73 Your company's sales were $2,000 last year, and they are forecasted to rise by 100 percent during the coming year. Here is the latest balance sheet: Cash $ 100 Accounts payable S200 Receivables 300 Notes payable 200 Inventory 800 Accruals 20 Total current assets $1,200 Total current liabilities 5420 Long-term debt 780 Common stock 400 Net Fixed Assets 800 Retained earnings 400 Total assets $2.000 Total liabilities and equity $2.000 Fixed assets were used to only 30 percent of capacity last year, and year-end inventory holdings were $100 greater than were needed to support the $2,000 of sales. The other current assets (cash and receivables) were at their proper levels. All assets would be a constant percentage of sales if excess capacity did not exist that is all assets would increase at the same rate as sales if no excess capacity existed. The company's after-tax profit margin will be 3 percent, and its payout ratio will be 80 percent. If all additional funds needed (AFN) are raised as notes payable and financing feedbacks are ignored, what will the current ratio be at the end of the coming year? A. a. 1.17 B. b. 1.93 C.C2.19 D. d. 2.50 E. e. 2.73