Question

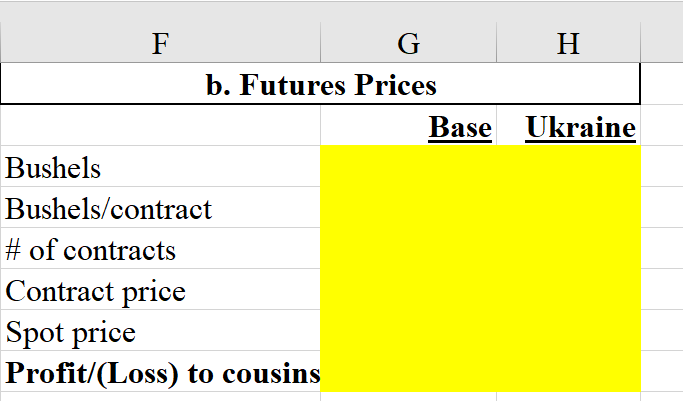

Your cousins grow corn in Wisconsin and plan to harvest 5,000,000 bushels at the end of the season. They are unsure whether to sell the

Your cousins grow corn in Wisconsin and plan to harvest 5,000,000 bushels at the end of the season. They are unsure whether to sell the futures contracts and lock the price in at $4.55/bushel or take a gamble and sell it all at the spot price at season's end. They think they can get $4.70/bushel based on historical prices and their own analysis.

Assuming no transaction costs and each contract covers 5,000 bushels, what will the cousins' profit/loss be if they sell the contracts and the spot price is $4.80 at maturity? Ukraine had a bumper harvest and spot prices fall to $3.95/bushel, what will the cousins' profit/loss be now?

IMPORTANT: SHOW FORMULAS USED TO CALCULATE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started