Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your employer has asked you to explain the difference between severance pay that Ontario employees and employees covered under the Canada Labour Code may

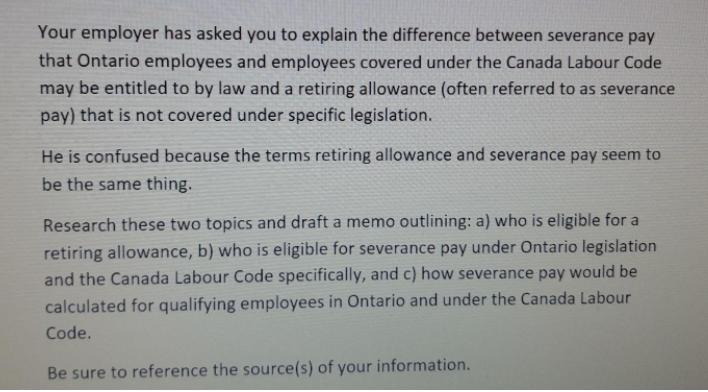

Your employer has asked you to explain the difference between severance pay that Ontario employees and employees covered under the Canada Labour Code may be entitled to by law and a retiring allowance (often referred to as severance pay) that is not covered under specific legislation. He is confused because the terms retiring allowance and severance pay seem to be the same thing. Research these two topics and draft a memo outlining: a) who is eligible for a retiring allowance, b) who is eligible for severance pay under Ontario legislation and the Canada Labour Code specifically, and c) how severance pay would be calculated for qualifying employees in Ontario and under the Canada Labour Code. Be sure to reference the source(s) of your information.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

AA retirement allowance is paid to someone who has worked for the company for a long ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started