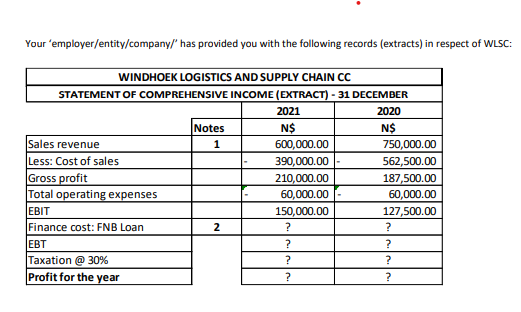

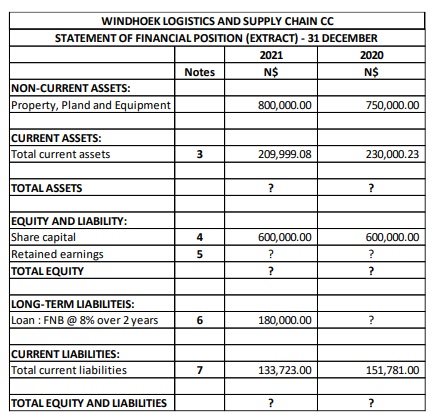

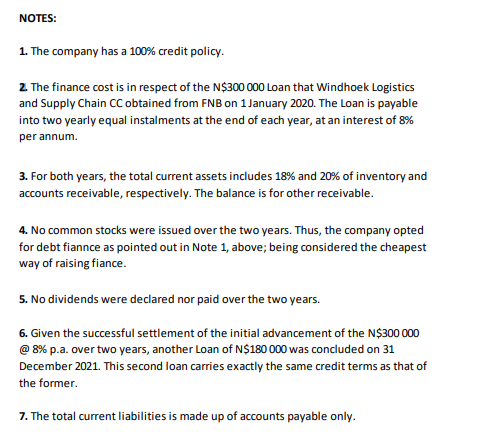

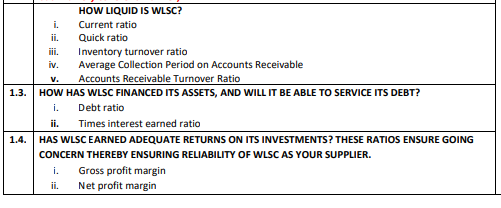

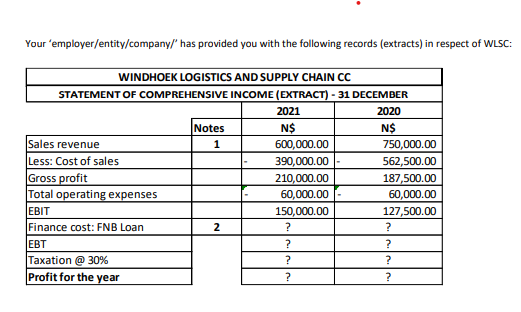

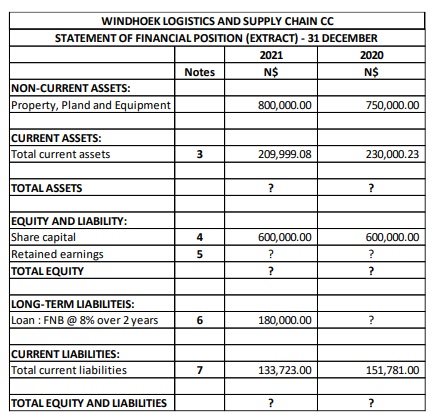

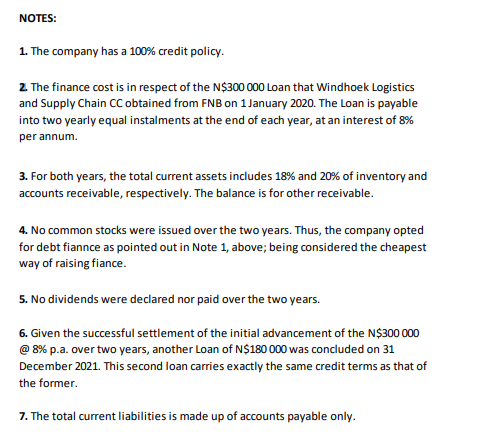

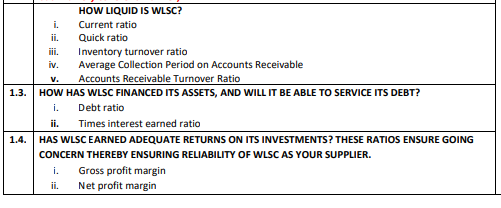

Your employer/entity/company/' has provided you with the following records (extracts) in respect of WLSC: WINDHOEK LOGISTICS AND SUPPLY CHAIN CC STATEMENT OF COMPREHENSIVE INCOME (EXTRACT) - 31 DECEMBER 2021 2020 Notes N$ N$ Sales revenue 1 600,000.00 750,000.00 Less: Cost of sales 390,000.00 562,500.00 Gross profit 210,000.00 187,500.00 Total operating expenses 60,000.00 60,000.00 EBIT 150,000.00 127,500.00 Finance cost: FNB Loan 2 ? ? EBT ? ? Taxation @ 30% ? ? Profit for the year ? ? WINDHOEK LOGISTICS AND SUPPLY CHAIN CC STATEMENT OF FINANCIAL POSITION (EXTRACT) - 31 DECEMBER 2021 2020 Notes N$ N$ 800,000.00 750,000.00 209,999.08 230,000.23 ? ? 600,000.00 600,000.00 ? ? ? 180,000.00 133,723.00 ? NON-CURRENT ASSETS: Property, Pland and Equipment CURRENT ASSETS: Total current assets TOTAL ASSETS EQUITY AND LIABILITY: Share capital Retained earnings TOTAL EQUITY LONG-TERM LIABILITEIS: Loan: FNB @ 8% over 2 years CURRENT LIABILITIES: Total current liabilities TOTAL EQUITY AND LIABILITIES 3 4 5 6 7 ? ? 151,781.00 ? NOTES: 1. The company has a 100% credit policy. 2. The finance cost is in respect of the N$300 000 Loan that Windhoek Logistics and Supply Chain CC obtained from FNB on 1 January 2020. The Loan is payable into two yearly equal instalments at the end of each year, at an interest of 8% per annum. 3. For both years, the total current assets includes 18% and 20% of inventory and accounts receivable, respectively. The balance is for other receivable. 4. No common stocks were issued over the two years. Thus, the company opted for debt fiannce as pointed out in Note 1, above; being considered the cheapest way of raising fiance. 5. No dividends were declared nor paid over the two years. 6. Given the successful settlement of the initial advancement of the N$300 000 @ 8% p.a. over two years, another Loan of N$180 000 was concluded on 31 December 2021. This second loan carries exactly the same credit terms as that of the former. 7. The total current liabilities is made up of accounts payable only. HOW LIQUID IS WLSC? Current ratio Quick ratio Inventory turnover ratio Average Collection Period on Accounts Receivable V. Accounts Receivable Turnover Ratio 1.3. HOW HAS WLSC FINANCED ITS ASSETS, AND WILL IT BE ABLE TO SERVICE ITS DEBT? i. Debt ratio ii. Times interest earned ratio 1.4. HAS WLSC EARNED ADEQUATE RETURNS ON ITS INVESTMENTS? THESE RATIOS ENSURE GOING CONCERN THEREBY ENSURING RELIABILITY OF WLSC AS YOUR SUPPLIER. i. Gross profit margin ii. Net profit margin i. ii. iii. iv. Your employer/entity/company/' has provided you with the following records (extracts) in respect of WLSC: WINDHOEK LOGISTICS AND SUPPLY CHAIN CC STATEMENT OF COMPREHENSIVE INCOME (EXTRACT) - 31 DECEMBER 2021 2020 Notes N$ N$ Sales revenue 1 600,000.00 750,000.00 Less: Cost of sales 390,000.00 562,500.00 Gross profit 210,000.00 187,500.00 Total operating expenses 60,000.00 60,000.00 EBIT 150,000.00 127,500.00 Finance cost: FNB Loan 2 ? ? EBT ? ? Taxation @ 30% ? ? Profit for the year ? ? WINDHOEK LOGISTICS AND SUPPLY CHAIN CC STATEMENT OF FINANCIAL POSITION (EXTRACT) - 31 DECEMBER 2021 2020 Notes N$ N$ 800,000.00 750,000.00 209,999.08 230,000.23 ? ? 600,000.00 600,000.00 ? ? ? 180,000.00 133,723.00 ? NON-CURRENT ASSETS: Property, Pland and Equipment CURRENT ASSETS: Total current assets TOTAL ASSETS EQUITY AND LIABILITY: Share capital Retained earnings TOTAL EQUITY LONG-TERM LIABILITEIS: Loan: FNB @ 8% over 2 years CURRENT LIABILITIES: Total current liabilities TOTAL EQUITY AND LIABILITIES 3 4 5 6 7 ? ? 151,781.00 ? NOTES: 1. The company has a 100% credit policy. 2. The finance cost is in respect of the N$300 000 Loan that Windhoek Logistics and Supply Chain CC obtained from FNB on 1 January 2020. The Loan is payable into two yearly equal instalments at the end of each year, at an interest of 8% per annum. 3. For both years, the total current assets includes 18% and 20% of inventory and accounts receivable, respectively. The balance is for other receivable. 4. No common stocks were issued over the two years. Thus, the company opted for debt fiannce as pointed out in Note 1, above; being considered the cheapest way of raising fiance. 5. No dividends were declared nor paid over the two years. 6. Given the successful settlement of the initial advancement of the N$300 000 @ 8% p.a. over two years, another Loan of N$180 000 was concluded on 31 December 2021. This second loan carries exactly the same credit terms as that of the former. 7. The total current liabilities is made up of accounts payable only. HOW LIQUID IS WLSC? Current ratio Quick ratio Inventory turnover ratio Average Collection Period on Accounts Receivable V. Accounts Receivable Turnover Ratio 1.3. HOW HAS WLSC FINANCED ITS ASSETS, AND WILL IT BE ABLE TO SERVICE ITS DEBT? i. Debt ratio ii. Times interest earned ratio 1.4. HAS WLSC EARNED ADEQUATE RETURNS ON ITS INVESTMENTS? THESE RATIOS ENSURE GOING CONCERN THEREBY ENSURING RELIABILITY OF WLSC AS YOUR SUPPLIER. i. Gross profit margin ii. Net profit margin i. ii. iii. iv