Question

Your firm, Goldmine Incorporated, is considering the purchase of a technology firm called Techworks. The purchase would result in a merged firm named GoldTech. Goldmine

Your firm, Goldmine Incorporated, is considering the purchase of a technology firm called Techworks. The purchase would result in a merged firm named GoldTech. Goldmine is considering this purchase because operating synergies with Techworks would result in total cash flows that are greater than the sum of the cash flows from the two companies if they operated separately.

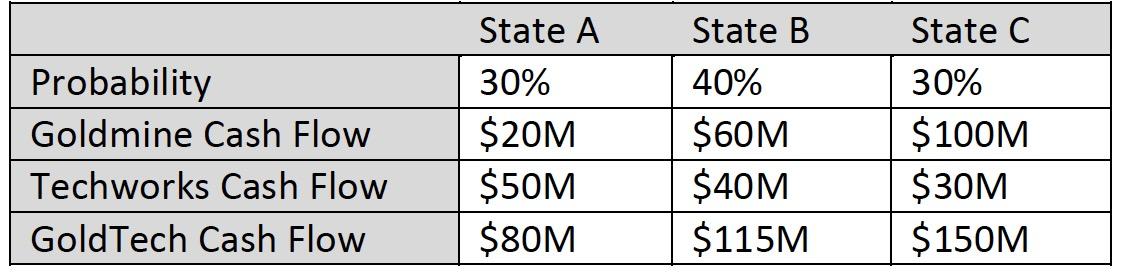

The following table outlines the possible cash flows produced by Goldmine and Techworks each year if they operated as solo businesses, and the possible cash flows produced by Goldmine and Techworks if they combined forces under the GoldTech name:

The expected return on Goldmine cash flows is 10 percent, and the expected return on Techworks cash flows is 16 percent. If the firms combined forces as GoldTech, then the expected return on GoldTech cash flows would be 11.5%. Both firms are all-equity and will operate in perpetuity. Each firm has 10M shares outstanding.

a) Assume that no merger announcement has been made. What are the share prices for Goldmine and Techworks? (You can ignore the GoldTech cash flows for this question.)

Goldmine announces it will purchase all of the shares of Techworks and pay a premium of 25% on the Techworks share price that you calculated in part (a). This will be a stock-for-stock merger. That is, Goldmine will issue shares in its own firm and exchange them for shares in Techworks. The exchange will be based on the Goldmine share price and value of Techworks with the 25% premium. Assume that the Goldmine share price does not change following the announcement.

b) What percentage of Goldmine has to be sold in order to acquire all of the shares in Techworks?

c) Is the merger a good idea? (Compare the value created from the merger to its cost.)

d) What is the share price of GoldTech after the merger is completed? (Keep in mind that the number of shares outstanding for GoldTech will now equal the original 10M shares from Goldmine plus the shares issued in part (b). Compare the new share price for Gold Tech to the share price calculated for Goldmine in part,

Probability Goldmine Cash Flow Techworks Cash Flow GoldTech Cash Flow State A 30% $20M $50M $80M State B 40% $60M $40M $115M State C 30% $100M $30M $150M

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the share prices for Goldmine and Techworks if they operate as solo businesses we need to find the present value of their expected cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started