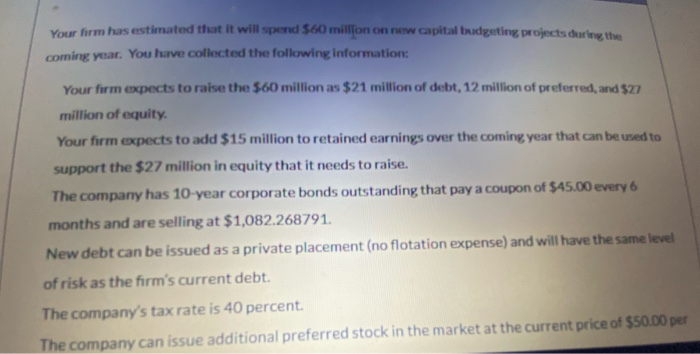

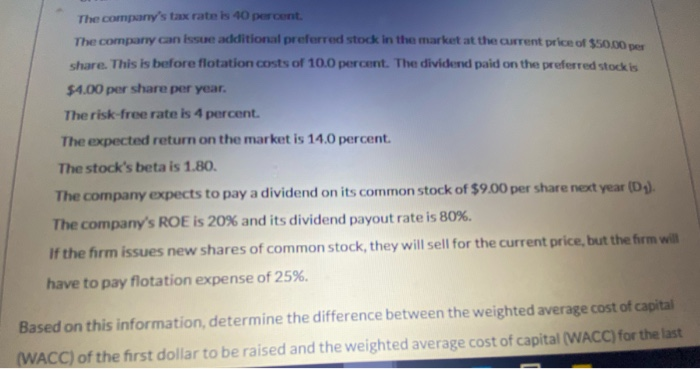

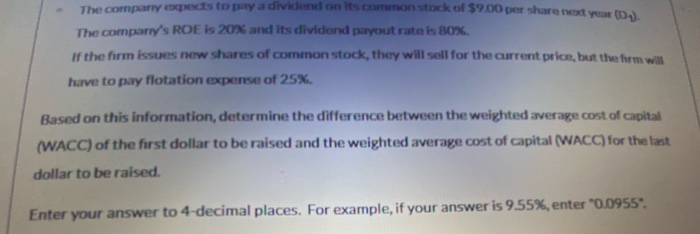

Your firm has estimated that it will spend 560 miljon Onew capital budgeting projects during the coming year. You have collected the following information Your firm expects to raise the $60 million as $21 million of debt, 12 million of preferred, and $27 million of equity Your firm expects to add $15 million to retained earnings over the coming year that can be used to support the $27 million in equity that it needs to raise. The company has 10-year corporate bonds outstanding that pay a coupon of $45.00 every 6 months and are selling at $1,082.268791. New debt can be issued as a private placement (no flotation expense) and will have the same level of risk as the firm's current debt. The company's tax rate is 40 percent. The company can issue additional preferred stock in the market at the current price of $50.00 per The company's tax rate is 40 percent. The company can use additional preferred stock in the market at the current pro share. This is before flotation costs of 10.0 percent. The dividend paid on the preferred stockis $4.00 per share per year. The risk-free rate is 4 percent. The expected return on the market is 14.0 percent. The stock's beta is 1.80. The company expects to pay a dividend on its common stock of $9.00 per share next year (D). The company's ROE is 20% and its dividend payout rate is 80%. If the firm issues new shares of common stock, they will sell for the current price, but the firm will have to pay flotation expense of 25%. Based on this information, determine the difference between the weighted average cost of capital (WACC) of the first dollar to be raised and the weighted average cost of capital ( WACC) for the last to a dividendon o n EOR OSV.00 per share The company's ROE is 20% and its dividend payout ratais BOX If the firm is now shares of common stock, they will all for the current price, but the form have to pay flotation expense of 25%. Based on this information, determine the difference between the weighted average cost of capital (WACC) of the first dollar to be raised and the weighted average cost of capital (WACC) for the last dollar to be raised. Enter your answer to 4-decimal places. For example, if your answer is 9.55%, enter"0.0955. Your firm has estimated that it will spend 560 miljon Onew capital budgeting projects during the coming year. You have collected the following information Your firm expects to raise the $60 million as $21 million of debt, 12 million of preferred, and $27 million of equity Your firm expects to add $15 million to retained earnings over the coming year that can be used to support the $27 million in equity that it needs to raise. The company has 10-year corporate bonds outstanding that pay a coupon of $45.00 every 6 months and are selling at $1,082.268791. New debt can be issued as a private placement (no flotation expense) and will have the same level of risk as the firm's current debt. The company's tax rate is 40 percent. The company can issue additional preferred stock in the market at the current price of $50.00 per The company's tax rate is 40 percent. The company can use additional preferred stock in the market at the current pro share. This is before flotation costs of 10.0 percent. The dividend paid on the preferred stockis $4.00 per share per year. The risk-free rate is 4 percent. The expected return on the market is 14.0 percent. The stock's beta is 1.80. The company expects to pay a dividend on its common stock of $9.00 per share next year (D). The company's ROE is 20% and its dividend payout rate is 80%. If the firm issues new shares of common stock, they will sell for the current price, but the firm will have to pay flotation expense of 25%. Based on this information, determine the difference between the weighted average cost of capital (WACC) of the first dollar to be raised and the weighted average cost of capital ( WACC) for the last to a dividendon o n EOR OSV.00 per share The company's ROE is 20% and its dividend payout ratais BOX If the firm is now shares of common stock, they will all for the current price, but the form have to pay flotation expense of 25%. Based on this information, determine the difference between the weighted average cost of capital (WACC) of the first dollar to be raised and the weighted average cost of capital (WACC) for the last dollar to be raised. Enter your answer to 4-decimal places. For example, if your answer is 9.55%, enter"0.0955