Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm is 50% debt financed and your debt beta is 1.2. The remainder of the firm is financed with equity, which has a

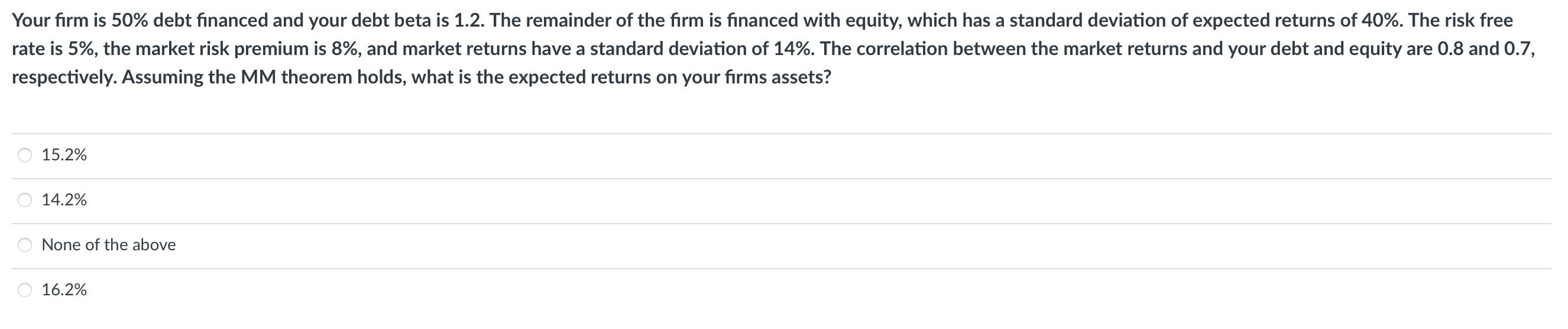

Your firm is 50% debt financed and your debt beta is 1.2. The remainder of the firm is financed with equity, which has a standard deviation of expected returns of 40%. The risk free rate is 5%, the market risk premium is 8%, and market returns have a standard deviation of 14%. The correlation between the market returns and your debt and equity are 0.8 and 0.7, respectively. Assuming the MM theorem holds, what is the expected returns on your firms assets? 15.2% 14.2% None of the above 16.2%

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Cost of debt Risk Free rate Debt beta x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609422290d2cf_210418.pdf

180 KBs PDF File

609422290d2cf_210418.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started