Your firm is considering a new three-year project. You know that the unlevered cost of equity for firms with a similar risk as your target

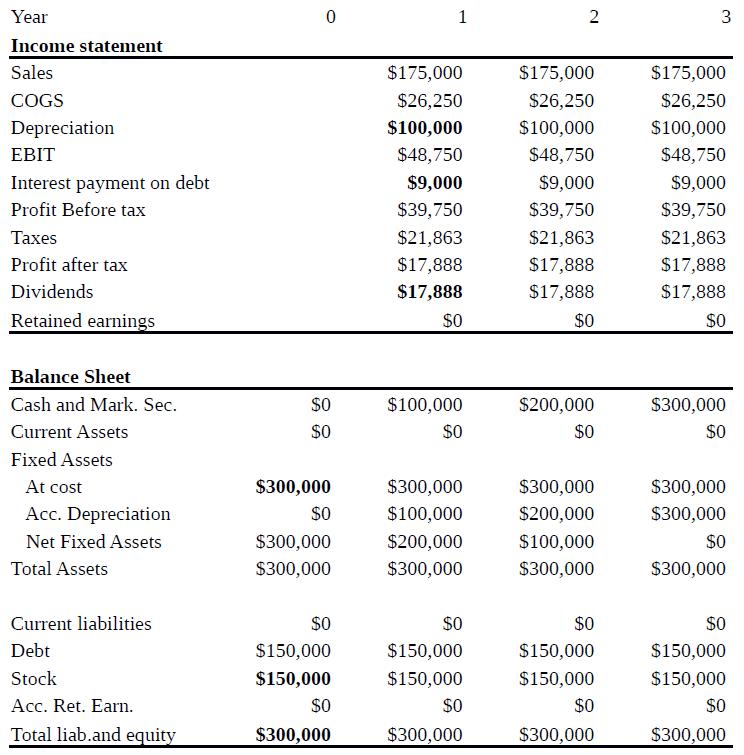

Your firm is considering a new three-year project. You know that the unlevered cost of equity for firms with a similar risk as your target is 8%. At the end of the project, all available funds are distributed to equity and debt holders. Use the following financial statements to answer the questions below

1. How large an equity investment does the project require upfront?

2. How much equity is recovered at the end of the project?

3. Show the cash to and from equity holders for the entire project. Don’t forget about dividends, initial, and terminal equity flows. Actual cash, not free cash flow!

4. Based on the cash flows in part c, what is the IRR for the equity holders?

5. What is the present value of the tax shield for this three-year project? Remember, this is not a perpetuity, it’s a three-year project.

6. Is this a good project for shareholders?

Year Income statement Sales COGS Depreciation EBIT Interest payment on debt Profit Before tax Taxes Profit after tax Dividends Retained earnings Balance Sheet Cash and Mark. Sec. Current Assets Fixed Assets At cost Acc. Depreciation Net Fixed Assets Total Assets Current liabilities Debt Stock Acc. Ret. Earn. Total liab.and equity 0 $0 $0 $300,000 $0 $300,000 $300,000 $0 $150,000 $150,000 $0 $300,000 1 $175,000 $26,250 $100,000 $48,750 $9,000 $39,750 $21,863 $17,888 $17,888 $0 $100,000 $0 $300,000 $100,000 $200,000 $300,000 $0 $150,000 $150,000 $0 $300,000 2 $175,000 $26,250 $100,000 $48,750 $9,000 $39,750 $21,863 $17,888 $17,888 $0 $200,000 $0 $300,000 $200,000 $100,000 $300,000 $0 $150,000 $150,000 $0 $300,000 3 $175,000 $26,250 $100,000 $48,750 $9,000 $39,750 $21,863 $17,888 $17,888 $0 $300,000 $0 $300,000 $300,000 $0 $300,000 $0 $150,000 $150,000 $0 $300,000

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Equity Investment Required 150 000 2 Equity Rec overed 150 000 3 Cash Flow ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started