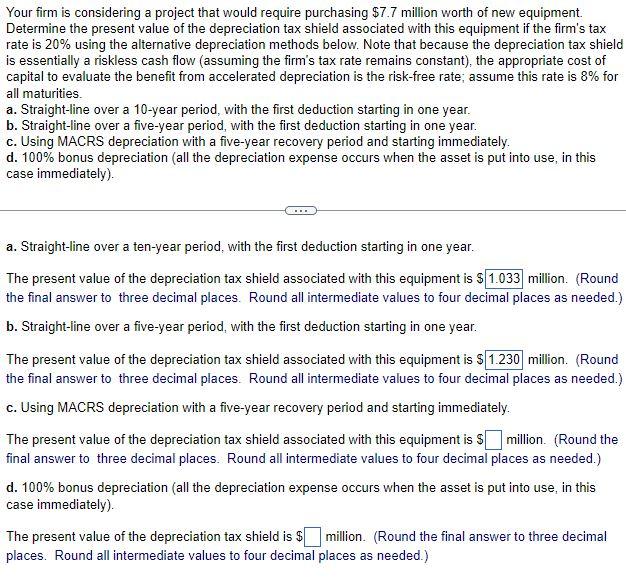

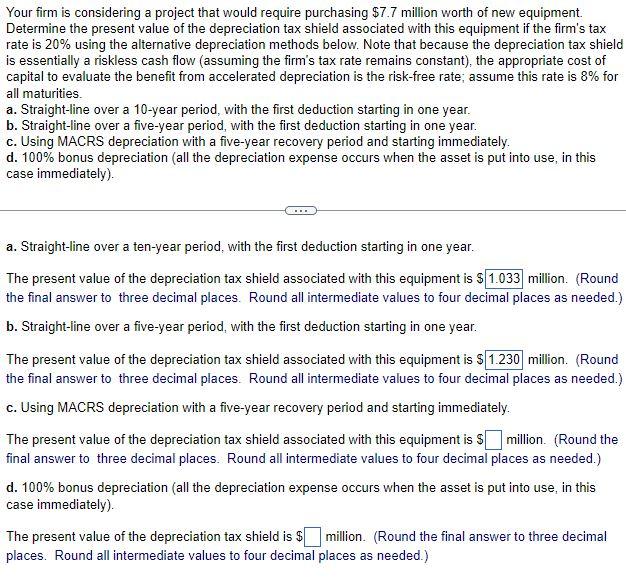

Your firm is considering a project that would require purchasing $7.7 million worth of new equipment. Determine the present value of the depreciation tax shield associated with this equipment if the firm's tax rate is 20% using the alternative depreciation methods below. Note that because the depreciation tax shield is essentially a riskless cash flow (assuming the firm's tax rate remains constant), the appropriate cost of capital to evaluate the benefit from accelerated depreciation is the risk-free rate; assume this rate is 8% for all maturities. a. Straight-line over a 10-year period, with the first deduction starting in one year. b. Straight-line over a five-year period, with the first deduction starting in one year. c. Using MACRS depreciation with a five-year recovery period and starting immediately. d. 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately). a. Straight-line over a ten-year period, with the first deduction starting in one year. The present value of the depreciation tax shield associated with this equipment is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) b. Straight-line over a five-year period, with the first deduction starting in one year. The present value of the depreciation tax shield associated with this equipment is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) c. Using MACRS depreciation with a five-year recovery period and starting immediately. The present value of the depreciation tax shield associated with this equipment is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) d. 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately). The present value of the depreciation tax shield is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) Your firm is considering a project that would require purchasing $7.7 million worth of new equipment. Determine the present value of the depreciation tax shield associated with this equipment if the firm's tax rate is 20% using the alternative depreciation methods below. Note that because the depreciation tax shield is essentially a riskless cash flow (assuming the firm's tax rate remains constant), the appropriate cost of capital to evaluate the benefit from accelerated depreciation is the risk-free rate; assume this rate is 8% for all maturities. a. Straight-line over a 10-year period, with the first deduction starting in one year. b. Straight-line over a five-year period, with the first deduction starting in one year. c. Using MACRS depreciation with a five-year recovery period and starting immediately. d. 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately). a. Straight-line over a ten-year period, with the first deduction starting in one year. The present value of the depreciation tax shield associated with this equipment is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) b. Straight-line over a five-year period, with the first deduction starting in one year. The present value of the depreciation tax shield associated with this equipment is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) c. Using MACRS depreciation with a five-year recovery period and starting immediately. The present value of the depreciation tax shield associated with this equipment is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.) d. 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately). The present value of the depreciation tax shield is $ million. (Round the final answer to three decimal places. Round all intermediate values to four decimal places as needed.)