Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm is considering adding a new plant to produce a chemical compound. You will operate the plant for 5 years. You have the

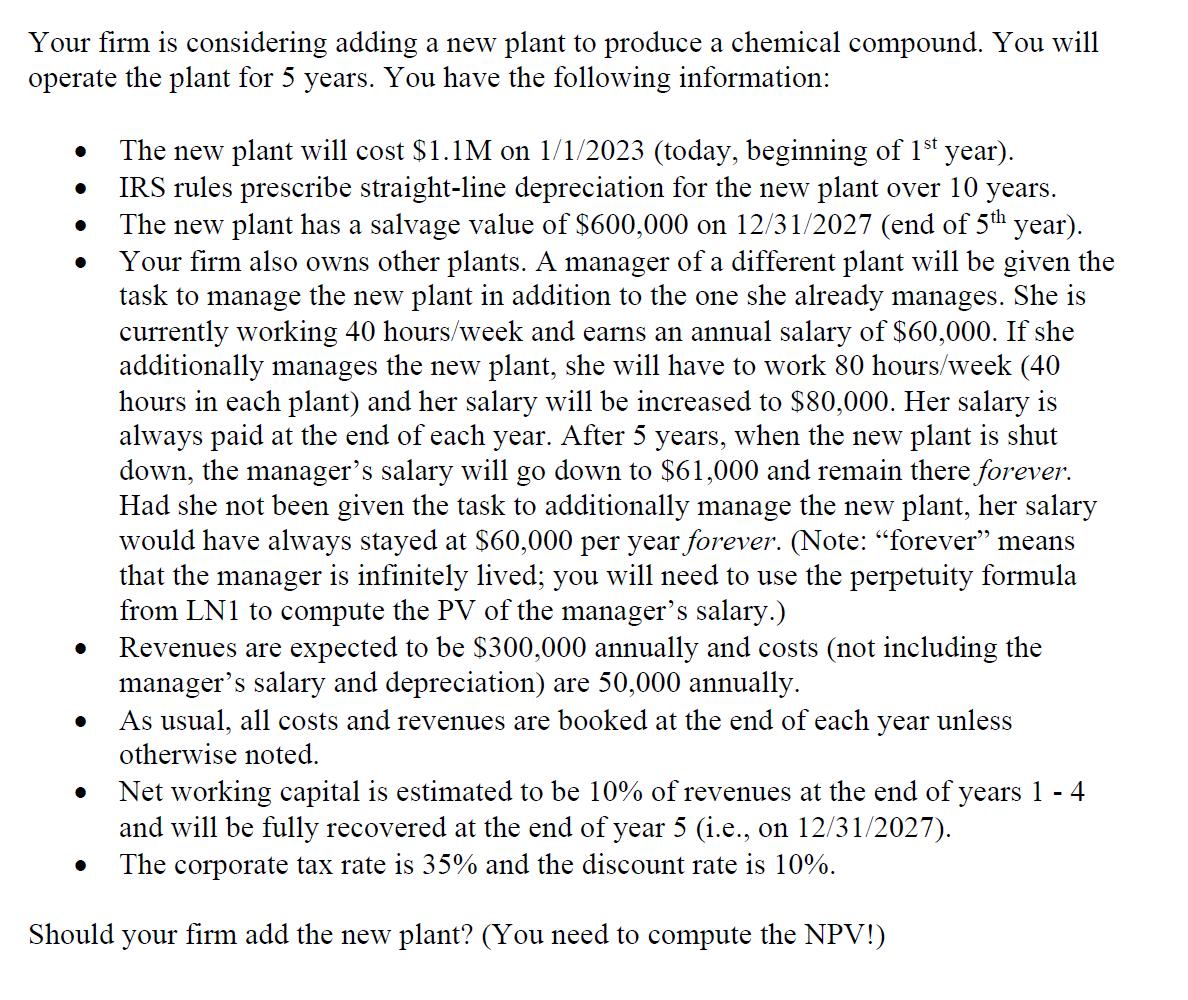

Your firm is considering adding a new plant to produce a chemical compound. You will operate the plant for 5 years. You have the following information: The new plant will cost $1.1M on 1/1/2023 (today, beginning of 1st year). IRS rules prescribe straight-line depreciation for the new plant over 10 years. The new plant has a salvage value of $600,000 on 12/31/2027 (end of 5th year). Your firm also owns other plants. A manager of a different plant will be given the task to manage the new plant in addition to the one she already manages. She is currently working 40 hours/week and earns an annual salary of $60,000. If she additionally manages the new plant, she will have to work 80 hours/week (40 hours in each plant) and her salary will be increased to $80,000. Her salary is always paid at the end of each year. After 5 years, when the new plant is shut down, the manager's salary will go down to $61,000 and remain there forever. Had she not been given the task to additionally manage the new plant, her salary would have always stayed at $60,000 per year forever. (Note: "forever" means that the manager is infinitely lived; you will need to use the perpetuity formula from LN1 to compute the PV of the manager's salary.) Revenues are expected to be $300,000 annually and costs (not including the manager's salary and depreciation) are 50,000 annually. As usual, all costs and revenues are booked at the end of each year unless otherwise noted. Net working capital is estimated to be 10% of revenues at the end of years 1 - 4 and will be fully recovered at the end of year 5 (i.e., on 12/31/2027). The corporate tax rate is 35% and the discount rate is 10%. Should your firm add the new plant? (You need to compute the NPV!)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether your firm should add the new plant we need to calculate the Net Present Value NPV of the project NPV measures the profitability of an investment by comparing the present value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started