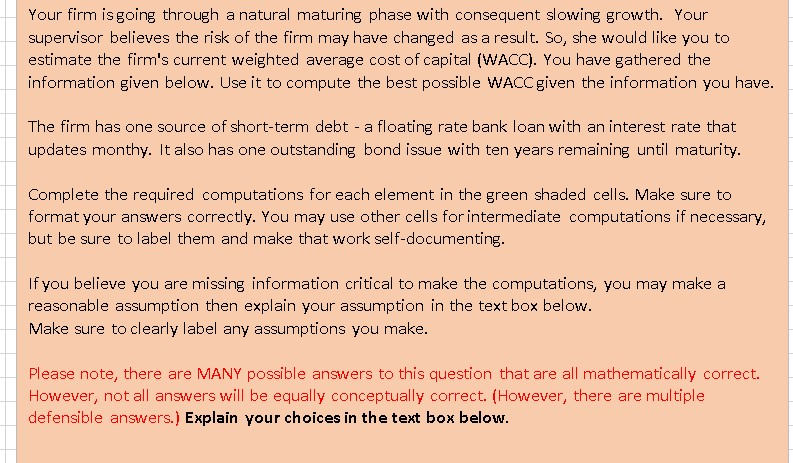

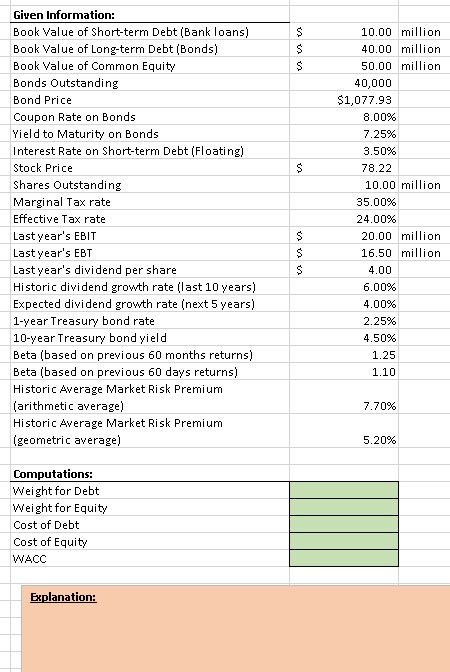

Your firm is going through a natural maturing phase with consequent slowing growth. Your supervisor believes the risk of the firm may have changed as a result. So, she would like you to estimate the firm's current weighted average cost of capital (WACC). You have gathered the information given below. Use it to compute the best possible WACC given the information you have. The firm has one source of short-term debt - a floating rate bank loan with an interest rate that updates monthy. It also has one outstanding bond issue with ten years remaining until maturity. Complete the required computations for each element in the green shaded cells. Make sure to format your answers correctly. You may use other cells for intermediate computations if necessary, but be sure to label them and make that work self-documenting. If you believe you are missing information critical to make the computations, you may make a reasonable assumption then explain your assumption in the text box below. Make sure to clearly label any assumptions you make. Please note, there are MANY possible answers to this question that are all mathematically correct. However, not all answers will be equally conceptually correct. (However, there are multiple defensible answers.) Explain your choices in the text box below. $ s S Given Information: Book Value of short-term Debt (Bank loans) Book Value of Long-term Debt (Bonds) Book Value of Common Equity Bonds Outstanding Bond Price Coupon Rate on Bonds Yield to Maturity on Bonds Interest Rate on Short-term Debt (Floating) Stock Price Shares Outstanding Marginal Tax rate Effective Tax rate Last year's EBIT Last year's EBT Last year's dividend per share Historic dividend growth rate (last 10 years) Expected dividend growth rate (next 5 years) 1-year Treasury bond rate 10-year Treasury bond yield Beta (based on previous 60 months returns) Beta (based on previous 60 days returns) Historic Average Market Risk Premium (arithmetic average) Historic Average Market Risk Premium (geometric average) 10.00 million 40.00 million 50.00 million 40,000 $1,077.93 8.00% 7.25% 3.50% 78.22 10.00 million 35.00% 24.00% 20.00 million 16.50 million 4.00 6.00% 4.00% 2.25% 4.50% 1.25 1.10 $ S $ 7.70% 5.20% Computations: Weight for Debt Weight for Equity Cost of Debt Cost of Equity WACC Explanation: Your firm is going through a natural maturing phase with consequent slowing growth. Your supervisor believes the risk of the firm may have changed as a result. So, she would like you to estimate the firm's current weighted average cost of capital (WACC). You have gathered the information given below. Use it to compute the best possible WACC given the information you have. The firm has one source of short-term debt - a floating rate bank loan with an interest rate that updates monthy. It also has one outstanding bond issue with ten years remaining until maturity. Complete the required computations for each element in the green shaded cells. Make sure to format your answers correctly. You may use other cells for intermediate computations if necessary, but be sure to label them and make that work self-documenting. If you believe you are missing information critical to make the computations, you may make a reasonable assumption then explain your assumption in the text box below. Make sure to clearly label any assumptions you make. Please note, there are MANY possible answers to this question that are all mathematically correct. However, not all answers will be equally conceptually correct. (However, there are multiple defensible answers.) Explain your choices in the text box below. $ s S Given Information: Book Value of short-term Debt (Bank loans) Book Value of Long-term Debt (Bonds) Book Value of Common Equity Bonds Outstanding Bond Price Coupon Rate on Bonds Yield to Maturity on Bonds Interest Rate on Short-term Debt (Floating) Stock Price Shares Outstanding Marginal Tax rate Effective Tax rate Last year's EBIT Last year's EBT Last year's dividend per share Historic dividend growth rate (last 10 years) Expected dividend growth rate (next 5 years) 1-year Treasury bond rate 10-year Treasury bond yield Beta (based on previous 60 months returns) Beta (based on previous 60 days returns) Historic Average Market Risk Premium (arithmetic average) Historic Average Market Risk Premium (geometric average) 10.00 million 40.00 million 50.00 million 40,000 $1,077.93 8.00% 7.25% 3.50% 78.22 10.00 million 35.00% 24.00% 20.00 million 16.50 million 4.00 6.00% 4.00% 2.25% 4.50% 1.25 1.10 $ S $ 7.70% 5.20% Computations: Weight for Debt Weight for Equity Cost of Debt Cost of Equity WACC Explanation