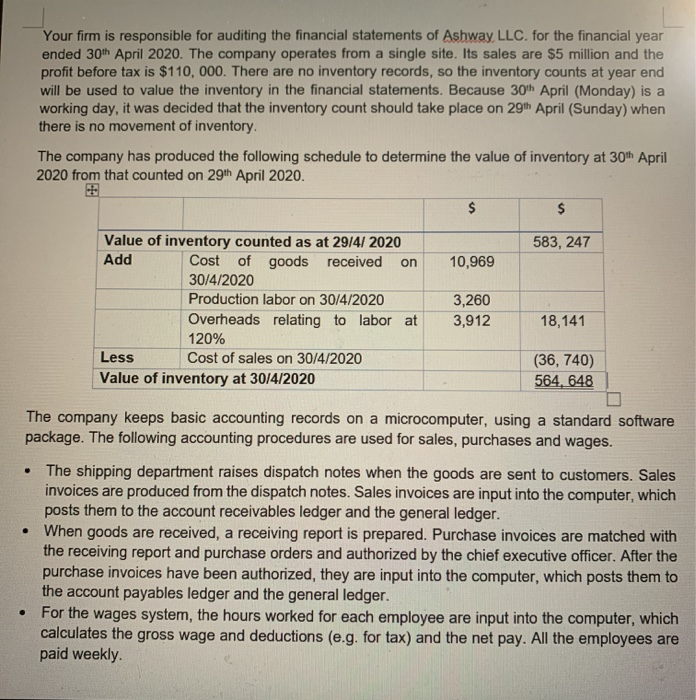

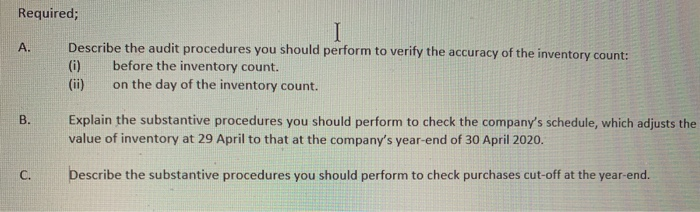

Your firm is responsible for auditing the financial statements of Ashway LLC. for the financial year ended 30th April 2020. The company operates from a single site. Its sales are $5 million and the profit before tax is $110,000. There are no inventory records, so the inventory counts at year end will be used to value the inventory in the financial statements. Because 30th April (Monday) is a working day, it was decided that the inventory count should take place on 29th April (Sunday) when there is no movement of inventory. The company has produced the following schedule to determine the value of inventory at 30th April 2020 from that counted on 29th April 2020. $ 583, 247 10,969 Value of inventory counted as at 29/4/ 2020 Add Cost of goods received on 30/4/2020 Production labor on 30/4/2020 Overheads relating to labor at 120% Less Cost of sales on 30/4/2020 Value of inventory at 3014/2020 3,260 3,912 18,141 (36,740) 564, 648 The company keeps basic accounting records on a microcomputer, using a standard software package. The following accounting procedures are used for sales, purchases and wages. The shipping department raises dispatch notes when the goods are sent to customers. Sales invoices are produced from the dispatch notes. Sales invoices are input into the computer, which posts them to the account receivables ledger and the general ledger. When goods are received, a receiving report is prepared. Purchase invoices are matched with the receiving report and purchase orders and authorized by the chief executive officer. After the purchase invoices have been authorized, they are input into the computer, which posts them to the account payables ledger and the general ledger. For the wages system, the hours worked for each employee are input into the computer, which calculates the gross wage and deductions (e.g. for tax) and the net pay. All the employees are paid weekly. . Required; I A. Describe the audit procedures you should perform to verify the accuracy of the inventory count: (0) before the inventory count. on the day of the inventory count. B. Explain the substantive procedures you should perform to check the company's schedule, which adjusts the value of inventory at 29 April to that at the company's year-end of 30 April 2020. c. Describe the substantive procedures you should perform to check purchases cut-off at the year-end