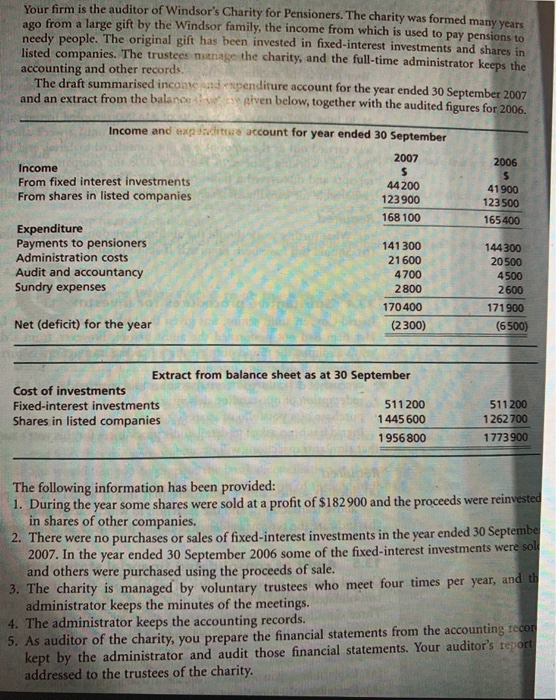

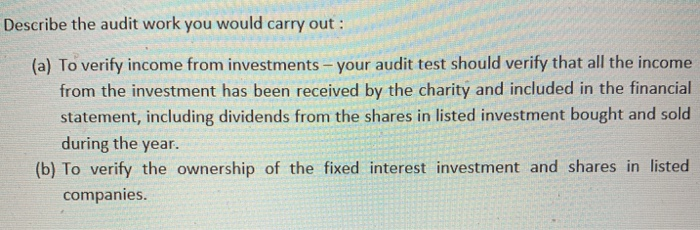

Your firm is the auditor of Windsor's Charity for Pensioners. The charity was formed many years ago from a large gift by the Windsor family, the income from which is used pay pensions to needy people. The original gift has been invested in fixed-interest investments and shares in listed companies. The trustees stage the charity, and the full-time administrator keeps the accounting and other records. The draft summarised income and expenditure account for the year ended 30 September 2007 and an extract from the balance given below, together with the audited figures for 2006. 2006 $ 41900 123 500 165 400 Income and experie account for year ended 30 September 2007 Income $ From fixed interest investments 44200 From shares in listed companies 123 900 168 100 Expenditure Payments to pensioners 141 300 Administration costs 21600 Audit and accountancy 4700 Sundry expenses 2800 170400 Net (deficit) for the year (2300) 144300 20500 4500 2600 171900 (6500) Extract from balance sheet as at 30 September Cost of investments Fixed-interest investments 511200 Shares in listed companies 1445600 1956 800 511200 1262 700 17 The following information has been provided: 1. During the year some shares were sold at a profit of $182900 and the proceeds were reinvested in shares of other companies. 2. There were no purchases or sales of fixed-interest investments in the year ended 30 Septembe 2007. In the year ended 30 September 2006 some of the fixed-interest investments were sol and others were purchased using the proceeds of sale. 3. The charity is managed by voluntary trustees who meet four times per year, and th administrator keeps the minutes of the meetings. 4. The administrator keeps the accounting records. 5. As auditor of the charity, you prepare the financial statements from the accounting recor kept by the administrator and audit those financial statements. Your auditor's report addressed to the trustees of the charity. Describe the audit work you would carry out: (a) To verify income from investments - your audit test should verify that all the income from the investment has been received by the charity and included in the financial statement, including dividends from the shares in listed investment bought and sold during the year. (b) To verify the ownership of the fixed interest investment and shares in listed companies