Answered step by step

Verified Expert Solution

Question

1 Approved Answer

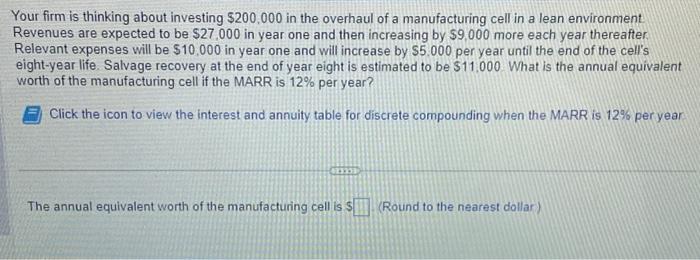

Your firm is thinking about investing $200,000 in the overhaul of a manufacturing cell in a lean environment. Revenues are expected to be $27,000

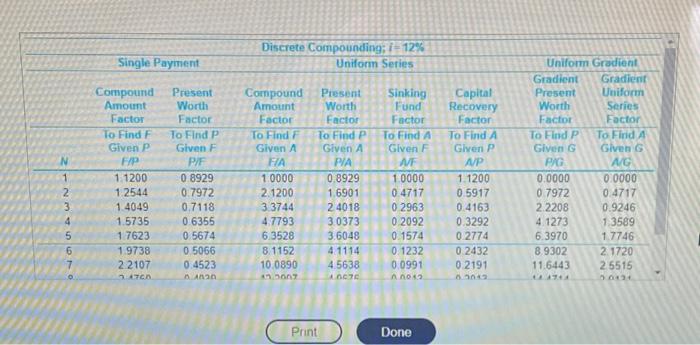

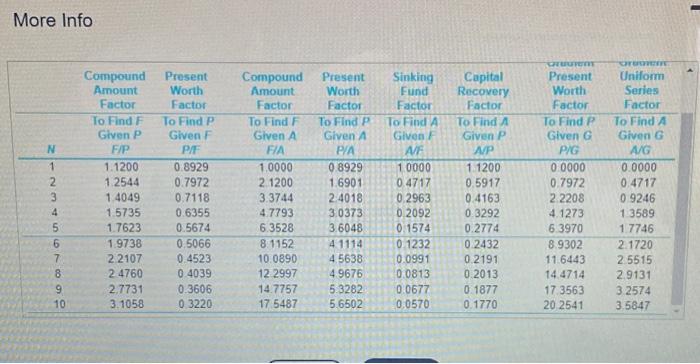

Your firm is thinking about investing $200,000 in the overhaul of a manufacturing cell in a lean environment. Revenues are expected to be $27,000 in year one and then increasing by $9,000 more each year thereafter. Relevant expenses will be $10,000 in year one and will increase by $5.000 per year until the end of the cell's eight-year life. Salvage recovery at the end of year eight is estimated to be $11.000 What is the annual equivalent worth of the manufacturing cell if the MARR is 12% per year? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year The annual equivalent worth of the manufacturing cell is S (Round to the nearest dollar) 2123YSSTO N Single Payment Compound Present Worth Amount Factor To Find F Given P F/P 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 74760 Factor To Find P Given F P/F 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 AA820 Discrete Compounding; -12% Uniform Series Compound Amount Factor To Find F Given A F/A 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 43.3607 Present Sinking Worth Fund Factor Factor To Find P Given A P/A 0.8929 1.6901 24018 3.0373 3.6048 41114 4.5638 LOCTE Print To Find A Given F AF 1.0000 0.4717 0.2963 0.2092 0.1574 01232 0.0991 A0012 Done Capital Recovery Factor To Find A Given P A/P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 6.3042 Uniform Gradient Gradient Gradient Present Uniform Worth Series Factor Factor To Find P Given G P/G 0.0000 0.7972 2.2208 4.1273 6.3970 8.9302 11.6443 14.4744 To Find A Given G A/G 0.0000 0.4717 0.9246 1.3589 1.7746 2.1720 2.5515 20121 More Info N1234 N 5 6 7 8 9 10 Compound Present Amount Factor Worth Factor To Find F Given P F/P 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 24760 2,7731 3.1058 To Find P Given F P/F 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0 3220 Compound Present Sinking Amount Factor Fund Factor Worth Factor To Find P Given A P/A 0.8929 To Find A Given F A/F 1.0000 1.6901 0.4717 0.2963 To Find F Given A FIA 1.0000 2 1200 3.3744 4.7793 6.3528 8.1152 10.0890 12 2997 14.7757 17.5487 2:4018 3.0373 3.6048 41114 4.5638 4.9676 5.3282 5.6502 0,2092 0.1574 01232 0.0991 0.0813 0.0677 0.0570 Capital Recovery Factor To Find A Given P A/P 1.1200 0.5917 0.4163. 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 QrBurem Present Worth Factor To Find P Given G P/G 0.0000 0.7972 2.2208 4.1273 6.3970 8.9302 11.6443 14.4714 17.3563 20 2541 Oregene Uniform Series Factor To Find A Given G A/G 0.0000 0.4717 0 9246 1:3589 1.7746 2.1720 2.5515 2.9131 3.2574 3.5847

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the annual equivalent worth of the manufacturing cell we need to determine the equivale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started