Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm needs to downsize one of its divisions and is tasking you with offering buyouts to two of the five non-managerial employees in

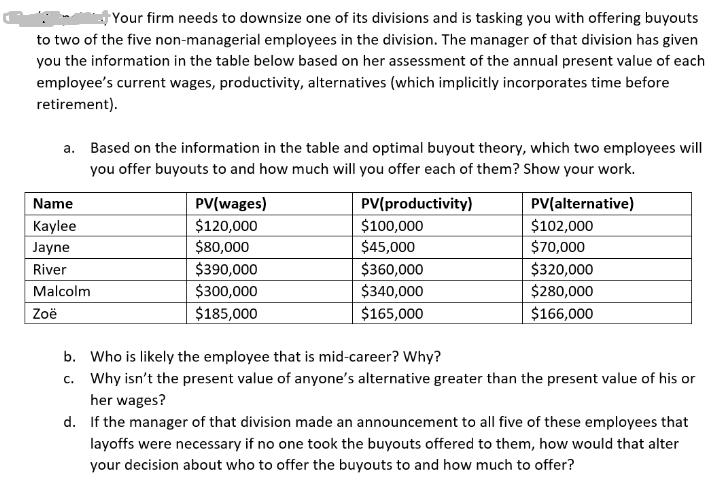

Your firm needs to downsize one of its divisions and is tasking you with offering buyouts to two of the five non-managerial employees in the division. The manager of that division has given you the information in the table below based on her assessment of the annual present value of each employee's current wages, productivity, alternatives (which implicitly incorporates time before retirement). a. Based on the information in the table and optimal buyout theory, which two employees will you offer buyouts to and how much will you offer each of them? Show your work. Name Kaylee Jayne River Malcolm Zo PV(productivity) $100,000 PV(alternative) $102,000 PV(wages) $120,000 $80,000 $45,000 $70,000 $390,000 $360,000 $320,000 $300,000 $340,000 $280,000 $185,000 $165,000 $166,000 b. Who is likely the employee that is mid-career? Why? c. Why isn't the present value of anyone's alternative greater than the present value of his or her wages? d. If the manager of that division made an announcement to all five of these employees that layoffs were necessary if no one took the buyouts offered to them, how would that alter your decision about who to offer the buyouts to and how much to offer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started