Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm owns a Volkswagen dealership, and you are considering entering into a 5-year agreement to also sell Audi A4s. The car would cost

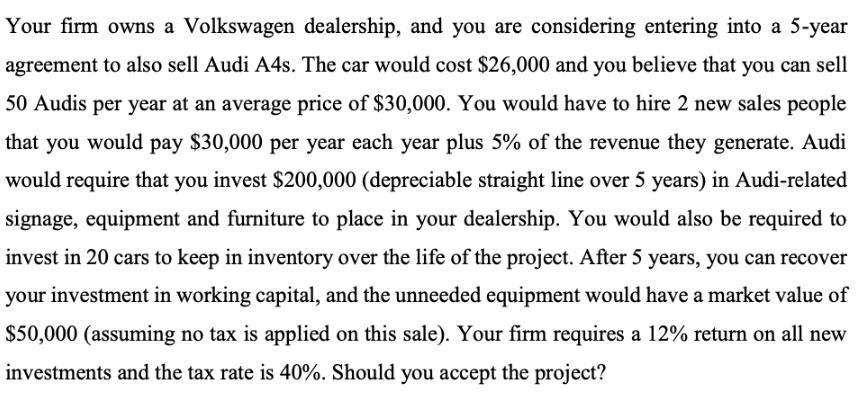

Your firm owns a Volkswagen dealership, and you are considering entering into a 5-year agreement to also sell Audi A4s. The car would cost $26,000 and you believe that you can sell 50 Audis per year at an average price of $30,000. You would have to hire 2 new sales people that you would pay $30,000 per year each year plus 5% of the revenue they generate. Audi would require that you invest $200,000 (depreciable straight line over 5 years) in Audi-related signage, equipment and furniture to place in your dealership. You would also be required to invest in 20 cars to keep in inventory over the life of the project. After 5 years, you can recover your investment in working capital, and the unneeded equipment would have a market value of $50,000 (assuming no tax is applied on this sale). Your firm requires a 12% return on all new investments and the tax rate is 40%. Should you accept the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether the project should be accepted lets calculate the net present value NPV of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started