Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm wants to issue a bond with semi-annual coupon payments, an annual coupon rate of 7%, and a face value of $1000. The bond

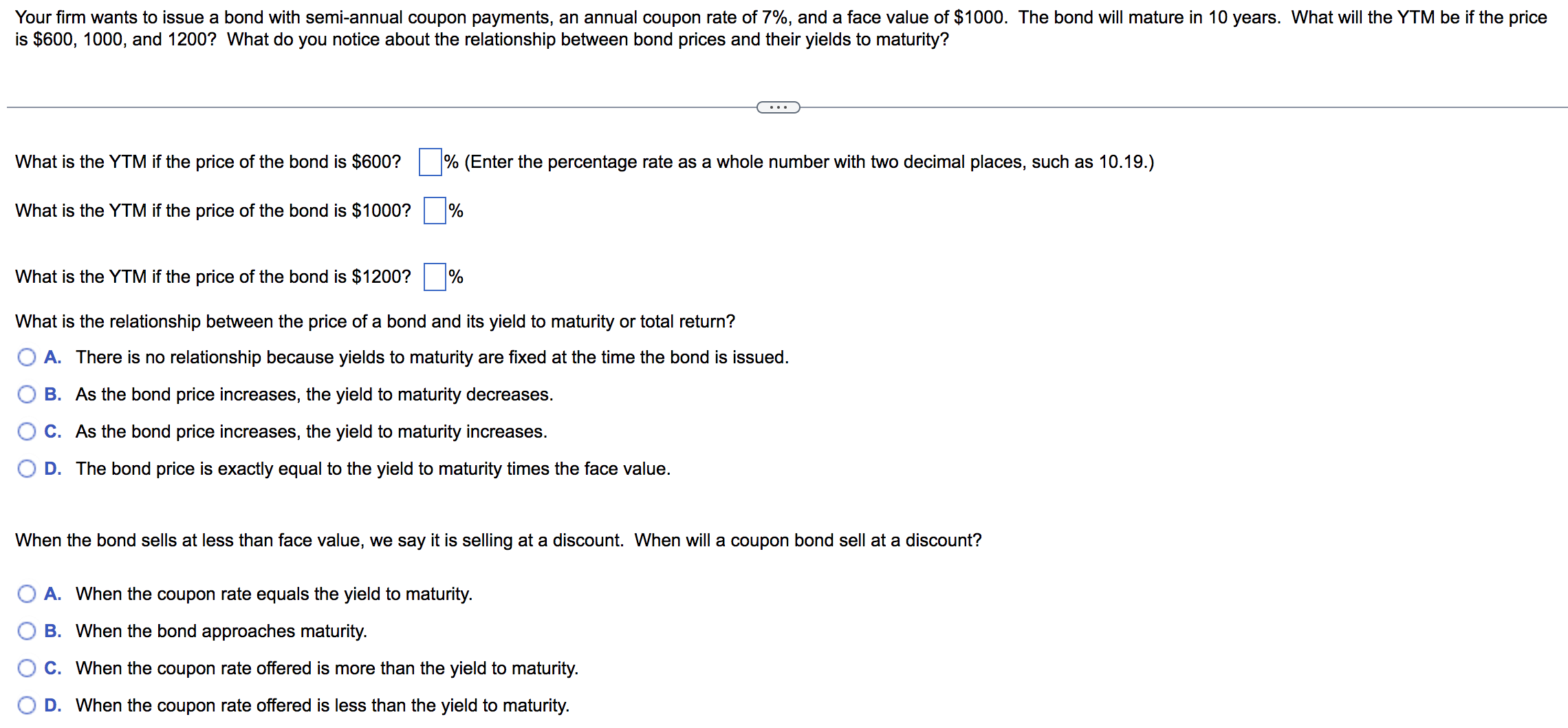

Your firm wants to issue a bond with semi-annual coupon payments, an annual coupon rate of 7%, and a face value of $1000. The bond will mature in 10 years. What will the YTM be if the price is $600,1000, and 1200 ? What do you notice about the relationship between bond prices and their yields to maturity? What is the YTM if the price of the bond is $600? What is the YTM if the price of the bond is $1000 ? What is the YTM if the price of the bond is $1200 ? \% What is the relationship between the price of a bond and its yield to maturity or total return? A. There is no relationship because yields to maturity are fixed at the time the bond is issued. B. As the bond price increases, the yield to maturity decreases. C. As the bond price increases, the yield to maturity increases. D. The bond price is exactly equal to the yield to maturity times the face value. When the bond sells at less than face value, we say it is selling at a discount. When will a coupon bond sell at a discount? A. When the coupon rate equals the yield to maturity. B. When the bond approaches maturity. C. When the coupon rate offered is more than the yield to maturity. D. When the coupon rate offered is less than the yield to maturity

Your firm wants to issue a bond with semi-annual coupon payments, an annual coupon rate of 7%, and a face value of $1000. The bond will mature in 10 years. What will the YTM be if the price is $600,1000, and 1200 ? What do you notice about the relationship between bond prices and their yields to maturity? What is the YTM if the price of the bond is $600? What is the YTM if the price of the bond is $1000 ? What is the YTM if the price of the bond is $1200 ? \% What is the relationship between the price of a bond and its yield to maturity or total return? A. There is no relationship because yields to maturity are fixed at the time the bond is issued. B. As the bond price increases, the yield to maturity decreases. C. As the bond price increases, the yield to maturity increases. D. The bond price is exactly equal to the yield to maturity times the face value. When the bond sells at less than face value, we say it is selling at a discount. When will a coupon bond sell at a discount? A. When the coupon rate equals the yield to maturity. B. When the bond approaches maturity. C. When the coupon rate offered is more than the yield to maturity. D. When the coupon rate offered is less than the yield to maturity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started