Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your first assignment in your new position as assistant financial analyst at Caledonia Products is to evaluate two new capital-budgeting proposals. Because this is your

Your first assignment in your new position as assistant financial analyst at Caledonia Products is to evaluate two new capital-budgeting proposals. Because this is your first assignment, you have been asked not only to provide a recommendation but also to respond to a number of questions aimed at assessing your understanding of the capital-budgeting process. This is a standard procedure for all new financial analysts at Caledonia, and it will serve to determine whether you are moved directly into the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows:

To: The New Financial Analysts

From: Mr. V. Morrison, CEO, Caledonia Products

Re: Capital-Budgeting Analysis

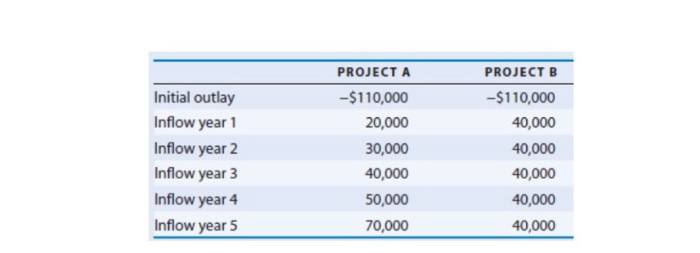

Provide an evaluation of two proposed projects, both with 5-year expected lives and identical initial outlays of $110,000. Both of these projects involve additions to Caledonias highly successful Avalon product line, and as a result, the required rate of return on both projects has been established at 12 percent. The expected free cash flows from each project are as follows:

Requirements: (25 Marks)

a. What is the payback period on each project? If Caledonia imposes a 3-year maximum acceptable payback period, which of these projects should be accepted? (4 marks for correct calculations of each project, 4*2 = 8 and 2 marks for decision = 10)

b. Determine the NPV for each of these projects. Should they be accepted? If Yes which project you should prefer. (4 marks for correct calculations of each project, 4*2 = 8 and 2 marks for decision = 10)

c. Determine the PI for each of these projects. Should they be accepted? If Yes which project you should prefer. (2 marks for correct calculations of each project, 2*2 = 4 and 1 marks for decision = 5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started