Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your first job is CFO of Gump Restaurants Co., which is considering opening fifteen (15) new restaurants at different locations around California this year.

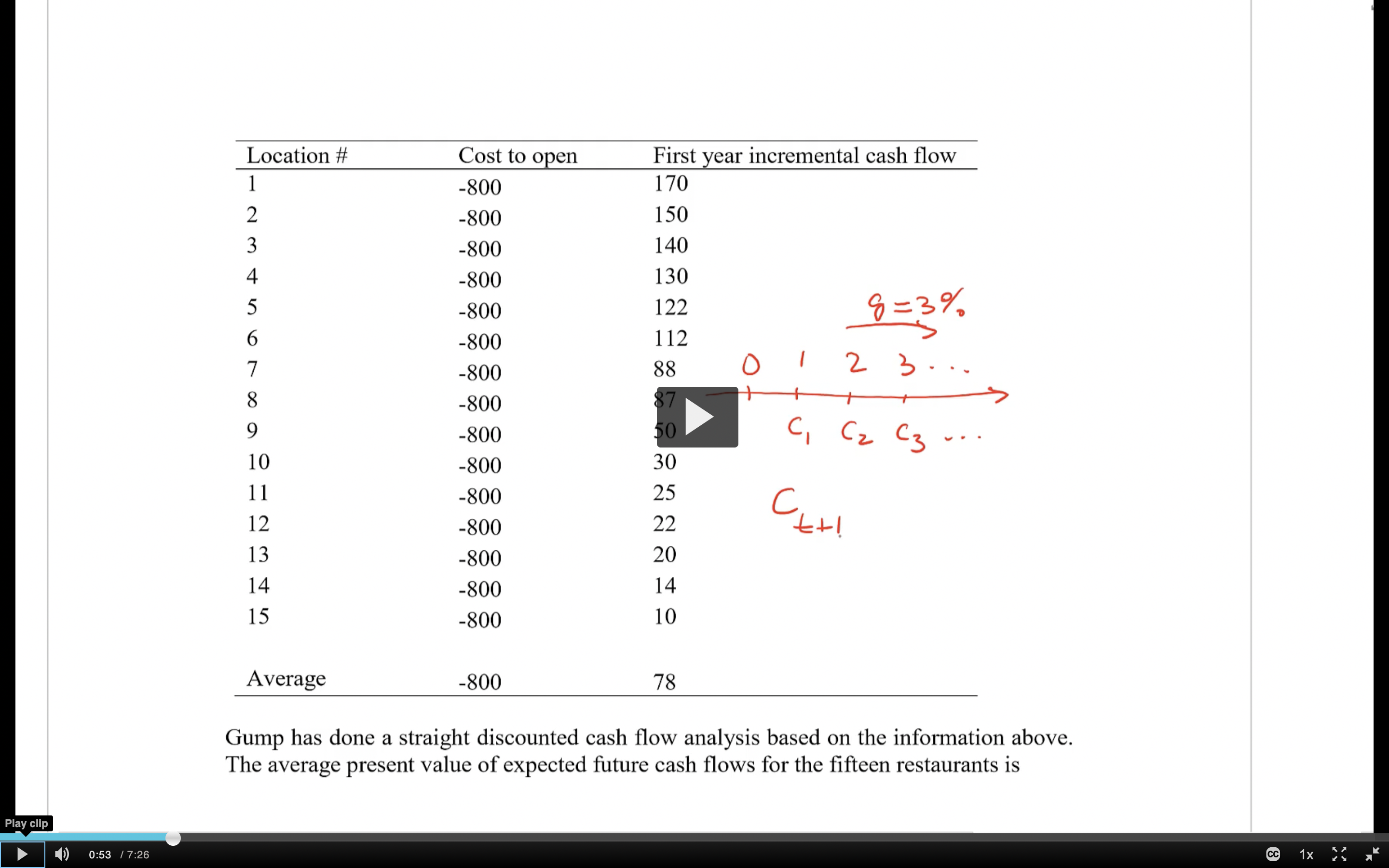

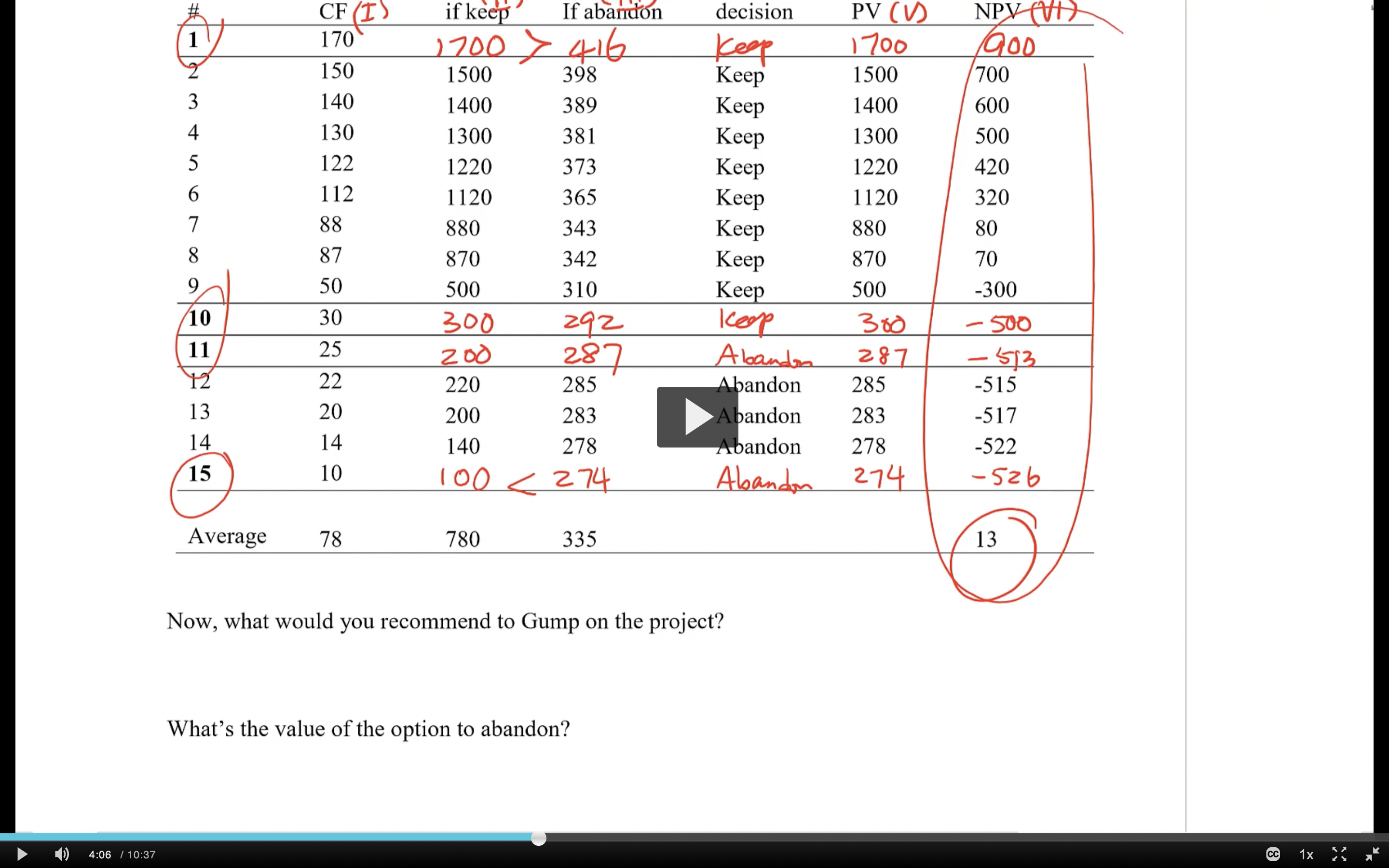

Your first job is CFO of Gump Restaurants Co., which is considering opening fifteen (15) new restaurants at different locations around California this year. Gump wants to know if the expansion plan makes sense from a financial standpoint. Gump tells you the following information: -- All the locations look equally good as of now. The only way to distinguish the good from the bad is to operate the restaurant for a year. -- Each restaurant costs $800,000 to open. --If a restaurant remains open after the first year, the incremental cash flow from the location is expected to grow at 3% in perpetuity from its first year level. -- If a restaurant is closed at the end of the first year, the expected salvage value of the equipment and the reclamation of working capital is $300,000 net of the costs of terminating the lease and employee layoffs, etc. -- Gump's investors require 13% rate of return on their investments. Play clip 0:53 / 7:26 Location # Cost to open First year incremental cash flow 1 -800 170 2345678 -800 150 -800 140 -800 130 -800 122 8=3% -800 112 -800 88 23... -800 87 9 -800 50 C Cz C 3 10 -800 30 11 -800 25 12 -800 22 ++! 13 -800 20 14 -800 14 15 -800 10 Average -800 78 Gump has done a straight discounted cash flow analysis based on the information above. The average present value of expected future cash flows for the fifteen restaurants is CC 1x 4:06 10:37 #1 CF (T) if keep If abandon decision PV (V) 170 1700 416 Keep 1700 NPV (VI) GOD 234567 150 1500 398 Keep 1500 700 140 1400 389 Keep 1400 600 4 130 1300 381 Keep 1300 500 122 1220 373 Keep 1220 420 112 1120 365 Keep 1120 320 88 880 343 Keep 880 80 8 87 870 342 Keep 870 70 9 50 500 310 Keep 500 -300 10 30 300 292 Keep 300 -500 11 25 200 287 Alandra 287 -513 12 22 220 285 Abandon 285 -515 13 20 200 283 Abandon 283 -517 14 14 140 278 Abandon 278 -522 15 10 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started