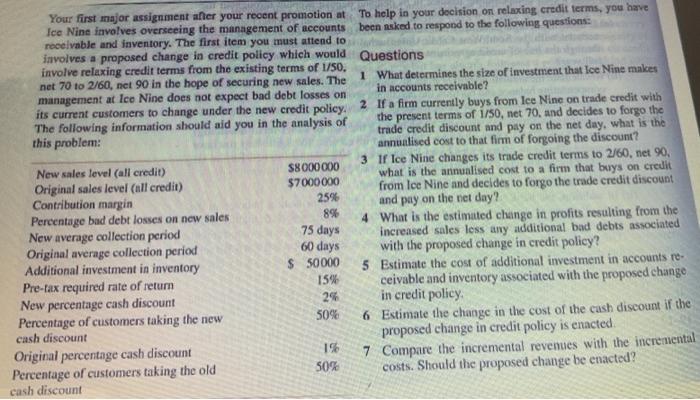

Your first major assignment after your recent promotion at To help in your decision on relaxing credit terms, you have Ice Nine involves overseeing the management of accounts been asked to respond to the following questions receivable and inventory. The first item you must attend to involves a proposed change in credit policy which would Questions involve relaxing credit terms from the existing terms of 1/50, net 70 to 2/60, net 90 in the hope of securing new sales. The 1 What determines the size of investment that Ice Nine makes management at Ice Nine does not expect bad debt losses on in accounts receivable? its current customers to change under the new credit policy. 2 If a firm currently buys from lee Nine on trade credit with The following information should aid you in the analysis of the present terms of 1/50, net 70, and decides to forgo the trade credit discount and pay on the net day, what is the this problem: annualised cost to that firm of forgoing the discount? New sales level (all credit) S8000000 3 If Ice Nine changes its trade credit terms to 2/60, net 90, what is the annualised cost to a firm that buys on credit Original sales level (all credit) $7000000 from Ice Nine and decides to forgo the trade credit discount Contribution margin 2596 and pay on the net day? Percentage bad debt losses on new sales 8% 4 What is the estimated change in profits resulting from the New average collection period increased sales loss any additional bad debts associated Original average collection period 60 days with the proposed change in credit policy? Additional investment in inventory $ 50000 5 Estimate the cost of additional investment in accounts re- Pre-tax required rate of return 15% ceivable and inventory associated with the proposed change New percentage cash discount 2% in credit policy Percentage of customers taking the new 50% 6 Estimate the change in the cost of the cash discount if the cash discount proposed change in credit policy is enacted Original percentage cash discount 1% 7 Compare the incremental revenues with the incremental Percentage of customers taking the old 50% costs. Should the proposed change be enacted? cash discount 75 days