Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend, Abu, has come to you for some assistance in evaluating a company he is considering investing in. Abu has provided you with

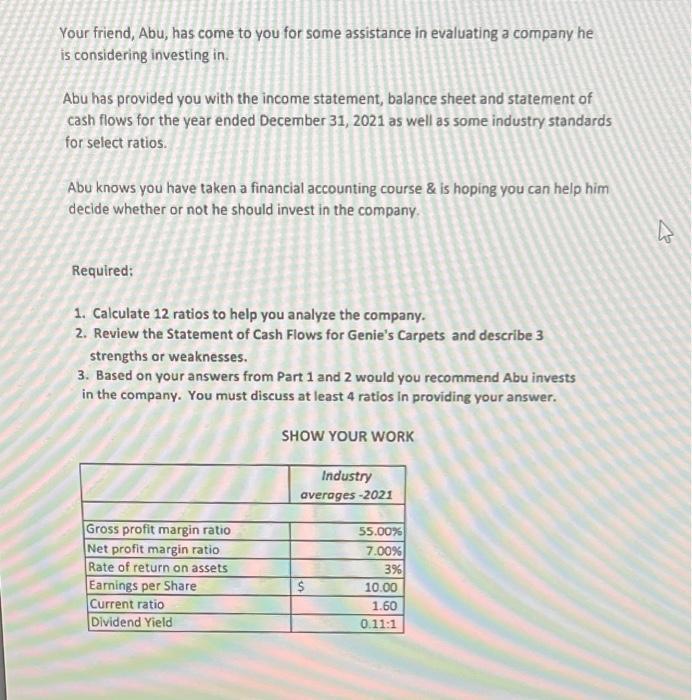

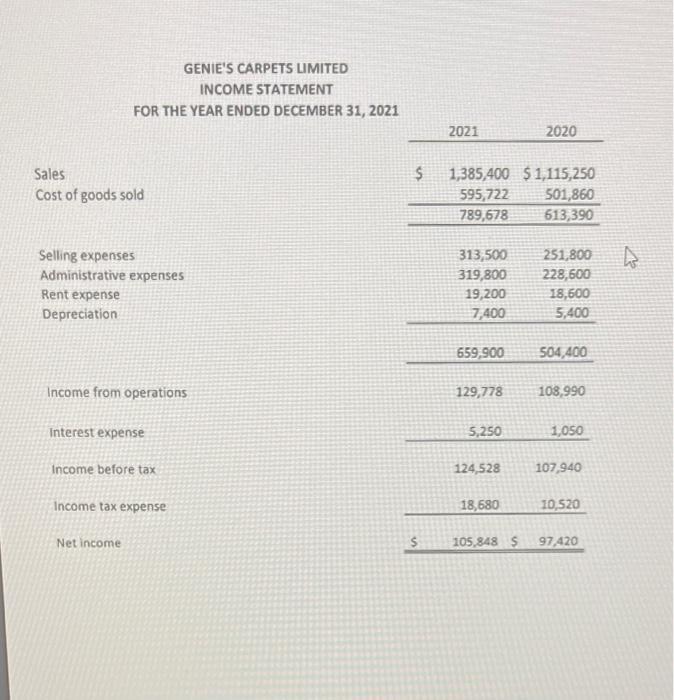

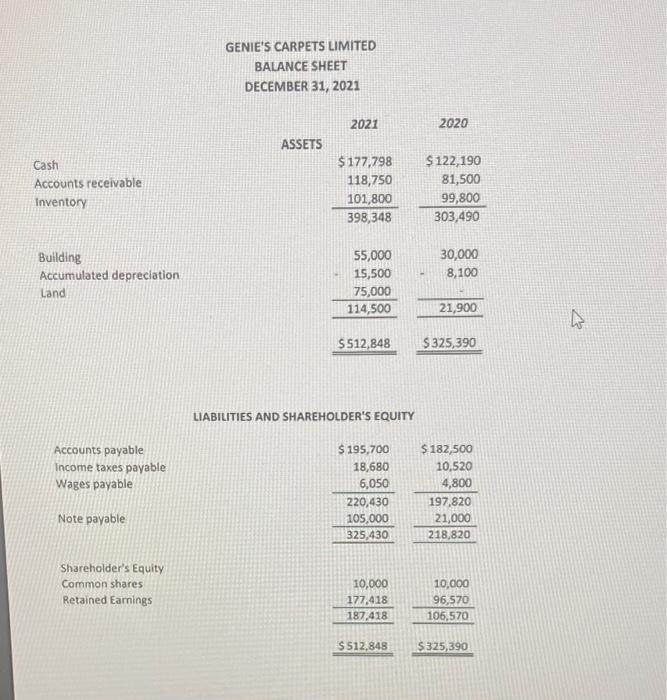

Your friend, Abu, has come to you for some assistance in evaluating a company he is considering investing in. Abu has provided you with the income statement, balance sheet and statement of cash flows for the year ended December 31, 2021 as well as some industry standards for select ratios. Abu knows you have taken a financial accounting course & is hoping you can help him decide whether or not he should invest in the company. Required: 1. Calculate 12 ratios to help you analyze the company. 2. Review the Statement of Cash Flows for Genie's Carpets and describe 3 strengths or weaknesses. 3. Based on your answers from Part 1 and 2 would you recommend Abu invests in the company. You must discuss at least 4 ratios in providing your answer. Gross profit margin ratio Net profit margin ratio Rate of return on assets Earnings per Share Current ratio Dividend Yield SHOW YOUR WORK Industry averages-2021 $ 55.00% 7.00% 3% 10.00 1.60 0.11:1 4 GENIE'S CARPETS LIMITED INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2021 Sales Cost of goods sold Selling expenses Administrative expenses Rent expense Depreciation Income from operations Interest expense Income before tax Income tax expense Net income $ 2021 1,385,400 595,722 789,678 659,900 313,500 251,800 319,800 228,600 19,200 7,400 129,778 5,250 124,528 18,680 2020 $ 105,848 $ $1,115,250 501,860 613,390 18,600 5,400 504,400 108,990 1,050 107,940 10,520 97,420 Cash Accounts receivable Inventory Building Accumulated depreciation Land Accounts payable Income taxes payable Wages payable Note payable Shareholder's Equity Common shares Retained Earnings GENIE'S CARPETS LIMITED BALANCE SHEET DECEMBER 31, 2021 ASSETS 2021 $177,798 118,750 101,800 398,348 55,000 15,500 75,000 114,500 LIABILITIES AND SHAREHOLDER'S EQUITY $195,700 18,680 6,050 220,430 105,000 325,430 $512,848 $325,390 10,000 177,418 187,418 2020 $512,848 $122,190 81,500 99,800 303,490 30,000 8,100 21,900 $182,500 10,520 4,800 197,820 21,000 218,820 10,000 96,570 106,570 $325,390 4 Cash flow from operating activities Net income Add depreciation Adjustment to reconcile net income to net cash provided by operating activities Net increase in current assets other than cash, Net increase in current liabilities GENIE'S CARPETS LIMITED STATEMENT OF CASH FLOWS YEAR ENDING DECEMBER 31, 2021 Cash flow from Financing activities Payment of dividends New loan proceeds Repayment of loans Cash flow from investing activities Purchase of land and building Net cash inflow Beginning cash Ending cash Additional information: 5 Selected data from the December 31, 2019 financial statements: Accounts receivable Inventory Accounts payable Total assets Shareholder equity Market price per share December 31, 2021 Market price per share December 31, 2020 Number of shares outstanding No preferred shares 5 5 $ $ 5 $ $ $ 2021 105,848 $ 7,400 39,250- 22,610 96,608 25,000- 89,000 5,000- 59,000 - 100,000 55,608 122,190 77,600 89,760 157,800 219.130 19,150 2020 20.00 15.00 10,000 97,420 5,400 13,940 32,840 121,720 20,000 4,000 24,000 177.798 5 122,190 97,720 24,470

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer PART 1 SNO RATIO FORMULA INDUSRTY STANDARD PATICULARS 2021 PATICULARS 2020 REMARKS 1 CURRENT RATIO CURRENTS ASSETSCURRENT LIABILITIES 16 398348220430 18 303490197820 153 CURRENT RATIO IS RATIO ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started