Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend Alex comes to you with his plan to start a business. He brings you the projected financial statements for the first two

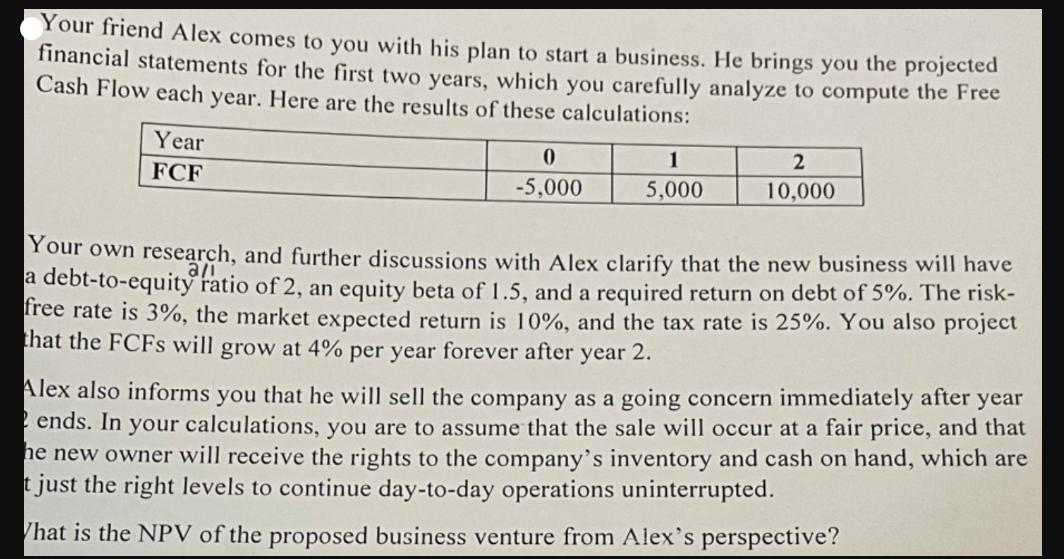

Your friend Alex comes to you with his plan to start a business. He brings you the projected financial statements for the first two years, which you carefully analyze to compute the Free Cash Flow each year. Here are the results of these calculations: Year FCF 0 1 2 -5,000 5,000 10,000 Your own research, and further discussions with Alex clarify that the new business will have a debt-to-equity ratio of 2, an equity beta of 1.5, and a required return on debt of 5%. The risk- free rate is 3%, the market expected return is 10%, and the tax rate is 25%. You also project that the FCFS will grow at 4% per year forever after year 2. Alex also informs you that he will sell the company as a going concern immediately after year ends. In your calculations, you are to assume that the sale will occur at a fair price, and that he new owner will receive the rights to the company's inventory and cash on hand, which are t just the right levels to continue day-to-day operations uninterrupted. What is the NPV of the proposed business venture from Alex's perspective?

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculating the NPV for Alexs Business Venture We can calculate the NPV using the following steps Te...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started