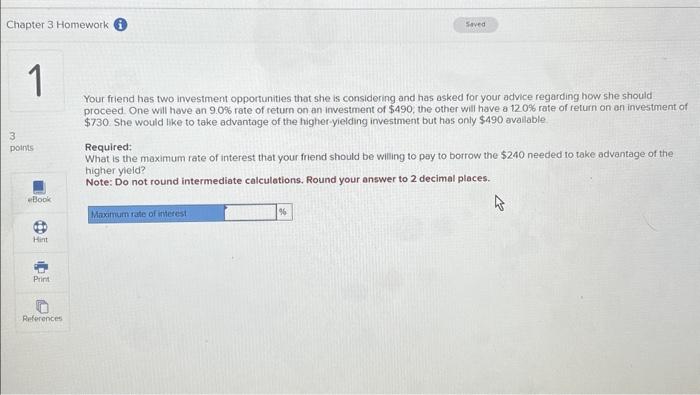

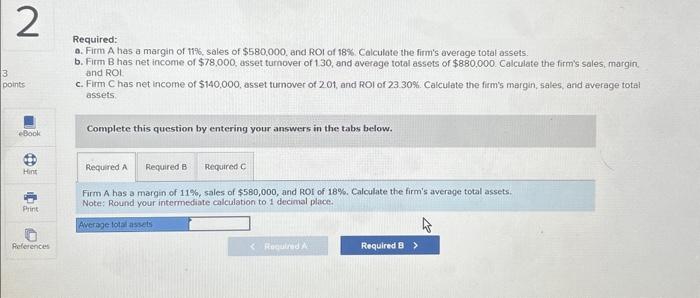

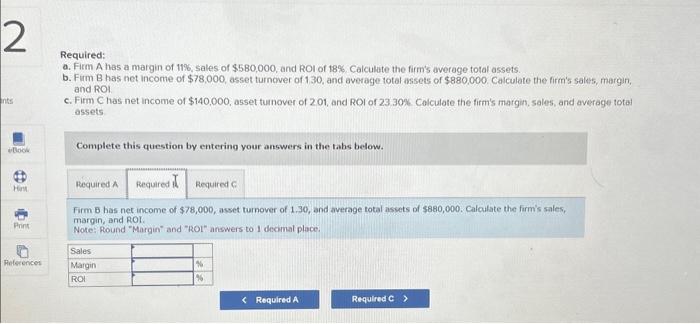

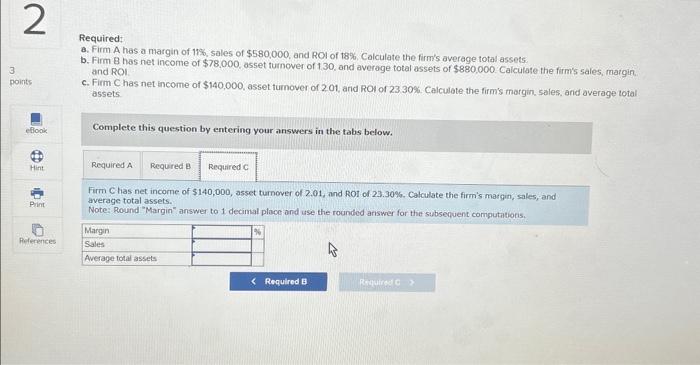

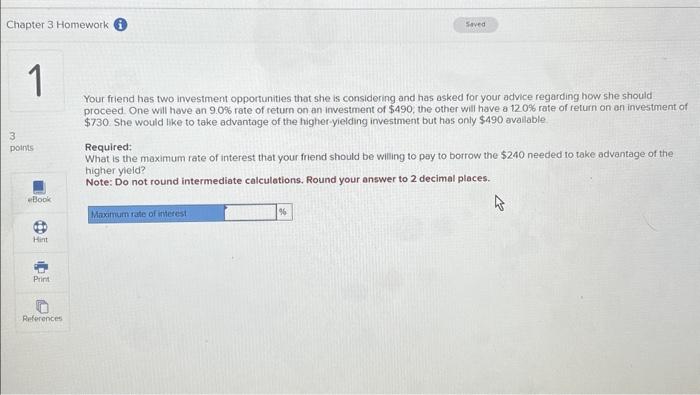

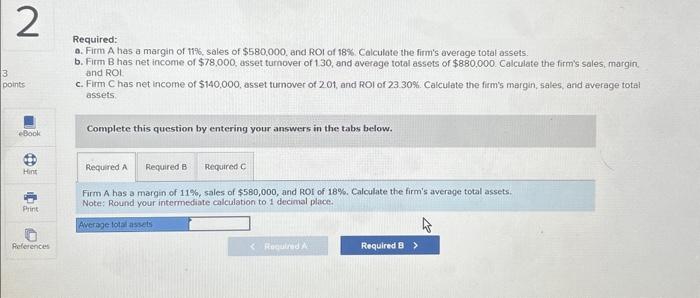

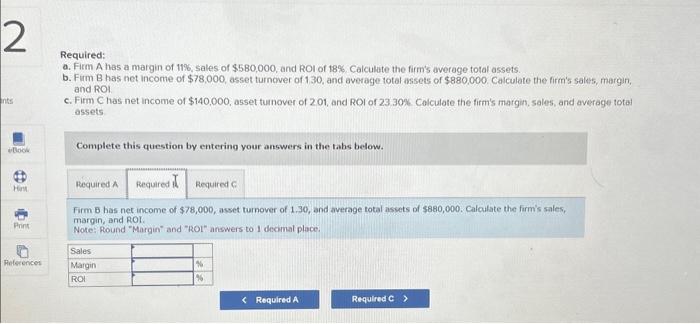

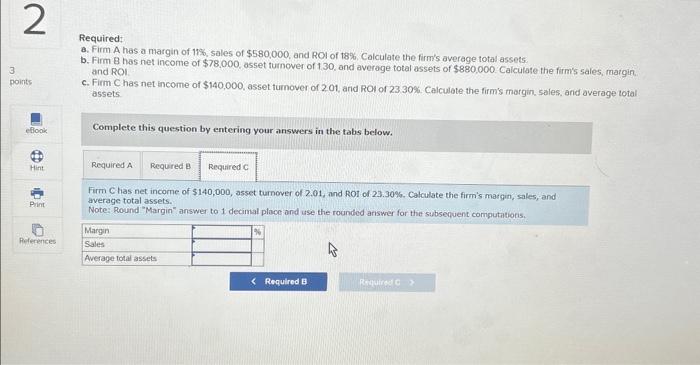

Your friend has two investment opportunities that she is considering and has asked for your advice regarding how she should proceed. One will have an 9.0% rate of return on an investment of $490, the other will have a 120% rate of return on an investment of $730. She would like to take advantoge of the higher-yielding investment but has only $490 avaliable Required: What is the maximum rate of interest that your frend should be willing to pay to borrow the $240 needed to take advantage of the higher yieid? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: a. Firm A has a margin of 11%, sales of $580.000, and ROI of 18%. Calculate the firm's average total assets. b. Firm B has net income of $78,000, asset turnover of 130 , and average total assets of $880,000. Calculate the firm's sales, margin and ROI c. Firm C has net income of $140,000, asset tumover of 201 , and ROI of 23.30%. Caiculate the firm's margin, sales, and average total assets Complete this question by entering your answers in the tabs below. Firm A has a margin of 11%, sales of $580,000, and ROI of 18%. Calculate the firm's average total assets. Note: Round your intermediate calculation to 1 decimal place. Required: a. Firm A has a margin of 11%, sales of $580,000, and ROl of 18%. Calculate the firm's average total assets. b. Firm B has net income of $78,000, asset turncver of 130 , and average total assets of $880,000. Calculate the firm's sales, margin, and ROH c. Firm C has net income of $140,000, asset tumover of 201 , and ROl of 23.30%. Colculate the firm's margin, sales, and averoge total assets Complete this question by entering your answers in the tahs below. Firm 8 has net income of $78,000, asset turnover of 1.30 , and average total assets of $880,000. Calaulate the firm's sales, margin, and ROI. Note: Round "Margin" and "ROL" answers to I decimal place. Required a. Firm A has a margin of 11%, sales of $580,000, and ROl of 18%, Calculate the firm's average total assets. b. Firm B has net income of $78,000, asset tumover of 130 , and average total assets of $880,000. Calculate the firm's sales, margin. and ROI c. Fim C has net income of $140,000, asset tumover of 201 , and ROI of 23.30%. Calculate the firm's margin, sales, and average total assets Complete this question by entering your answers in the tabs below. Firm Chas net incorne of $140,000, asset tumover of 2.01 , and ROl of 23.30%. Calculate the firm's margin, sales, and average total assets. Note: Round "Margin" answer to 1 decimal place and use the rounded arswer for the subsequent computhtions