Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend offers to you to be a part of his partnership business. If you agree to this, you will receive $6,000 at the

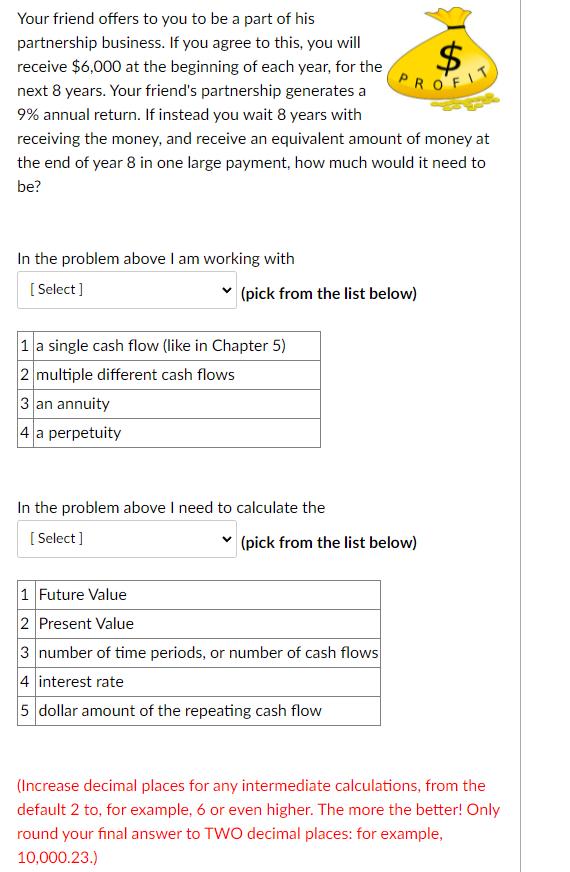

Your friend offers to you to be a part of his partnership business. If you agree to this, you will receive $6,000 at the beginning of each year, for the next 8 years. Your friend's partnership generates a 9% annual return. If instead you wait 8 years with receiving the money, and receive an equivalent amount of money at the end of year 8 in one large payment, how much would it need to be? In the problem above I am working with [Select] (pick from the list below) 1 a single cash flow (like in Chapter 5) 2 multiple different cash flows 3 an annuity 4 a perpetuity In the problem above I need to calculate the [Select] $ PROFIT (pick from the list below) 1 Future Value 2 Present Value 3 number of time periods, or number of cash flows 4 interest rate 5 dollar amount of the repeating cash flow (Increase decimal places for any intermediate calculations, from the default 2 to, for example, 6 or even higher. The more the better! Only round your final answer to TWO decimal places: for example, 10,000.23.)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The situation described in the question is that of receiving an annuity specifically an ordinary ann...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started