Answered step by step

Verified Expert Solution

Question

1 Approved Answer

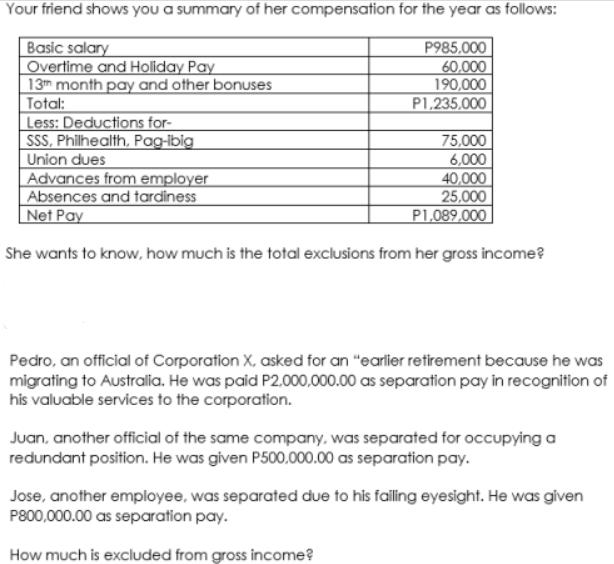

Your friend shows you a summary of her compensation for the year as follows: Basic salary P985.000 Overtime and Holiday Pay 60,000 13th month

Your friend shows you a summary of her compensation for the year as follows: Basic salary P985.000 Overtime and Holiday Pay 60,000 13th month pay and other bonuses 190,000 Total: P1,235,000 Less: Deductions for- SSS, Philhealth, Pag-ibig Union dues 75,000 6,000 Advances from employer 40,000 25,000 Absences and tardiness Net Pay P1,089,000 She wants to know, how much is the total exclusions from her gross income? Pedro, an official of Corporation X, asked for an "earlier retirement because he was migrating to Australia. He was paid P2,000,000.00 as separation pay in recognition of his valuable services to the corporation. Juan, another official of the same company, was separated for occupying a redundant position. He was given P500,000.00 as separation pay. Jose, another employee, was separated due to his failing eyesight. He was given P800,000.00 as separation pay. How much is excluded from gross income?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the total exclusions from your friends gross income and the amount excluded from gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started