Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your friend Simon and his family are migrating to Bristol, the U.K., in the summer this year. Simon learns from a real estate agent

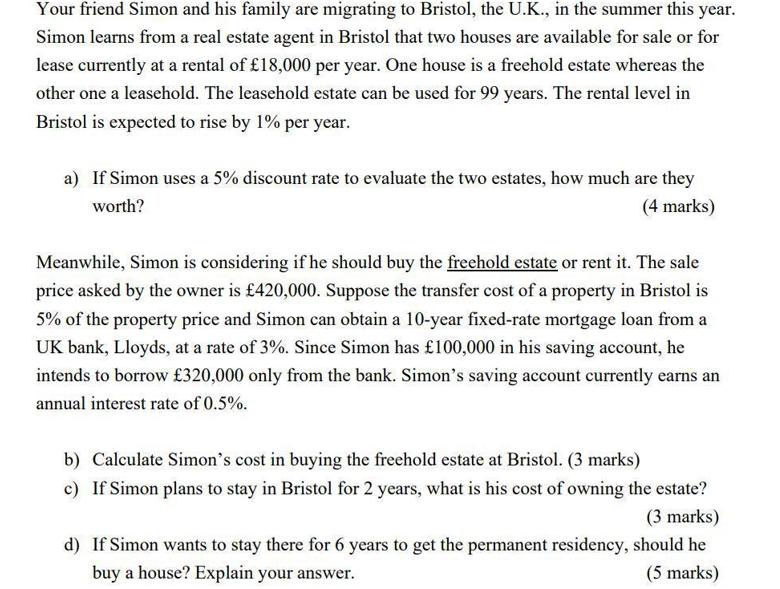

Your friend Simon and his family are migrating to Bristol, the U.K., in the summer this year. Simon learns from a real estate agent in Bristol that two houses are available for sale or for lease currently at a rental of 18,000 per year. One house is a freehold estate whereas the other one a leasehold. The leasehold estate can be used for 99 years. The rental level in Bristol is expected to rise by 1% per year. a) If Simon uses a 5% discount rate to evaluate the two estates, how much are they worth? (4 marks) Meanwhile, Simon is considering if he should buy the freehold estate or rent it. The sale price asked by the owner is 420,000. Suppose the transfer cost of a property in Bristol is 5% of the property price and Simon can obtain a 10-year fixed-rate mortgage loan from a UK bank, Lloyds, at a rate of 3%. Since Simon has 100,000 in his saving account, he intends to borrow 320,000 only from the bank. Simon's saving account currently earns an annual interest rate of 0.5%. b) Calculate Simon's cost in buying the freehold estate at Bristol. (3 marks) c) If Simon plans to stay in Bristol for 2 years, what is his cost of owning the estate? (3 marks) d) If Simon wants to stay there for 6 years to get the permanent residency, should he buy a house? Explain your answer. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To evaluate the two estates with a 5 discount rate you can use the formula for the present value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started