Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Kellogg's current stock price is $71 and has 345M shares outstanding (irrespective of what you calculated in Question 1) Assume that Kellogg made

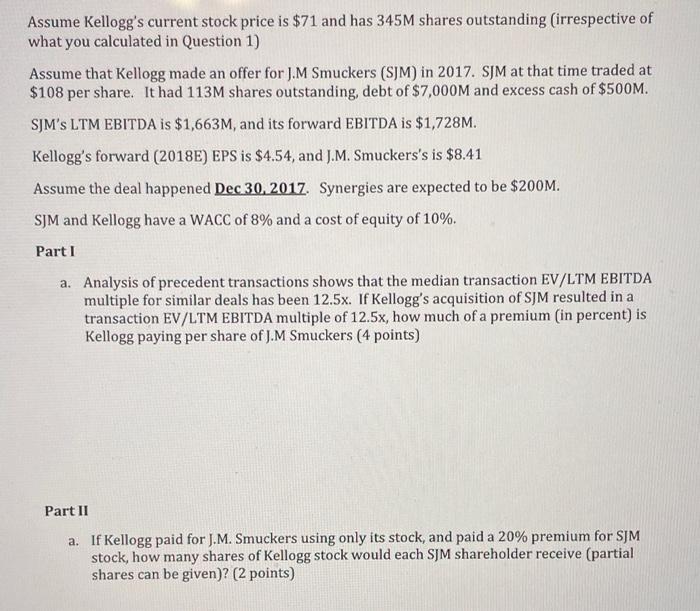

Assume Kellogg's current stock price is $71 and has 345M shares outstanding (irrespective of what you calculated in Question 1) Assume that Kellogg made an offer for J.M Smuckers (SJM) in 2017. SJM at that time traded at $108 per share. It had 113M shares outstanding, debt of $7,000M and excess cash of $500M. SJM's LTM EBITDA is $1,663M, and its forward EBITDA is $1,728M. Kellogg's forward (2018E) EPS is $4.54, and J.M. Smuckers's is $8.41 Assume the deal happened Dec 30, 2017. Synergies are expected to be $200M. SJM and Kellogg have a WACC of 8% and a cost of equity of 10%. Part I a. Analysis of precedent transactions shows that the median transaction EV/LTM EBITDA multiple for similar deals has been 12.5x. If Kellogg's acquisition of SJM resulted in a transaction EV/LTM EBITDA multiple of 12.5x, how much of a premium (in percent) is Kellogg paying per share of J.M Smuckers (4 points) Part II a. If Kellogg paid for J.M. Smuckers using only its stock, and paid a 20% premium for SJM stock, how many shares of Kellogg stock would each SJM shareholder receive (partial shares can be given)? (2 points)

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started