Question

Your friend Toni, a consultant for PriceEarthHouse LLP, has been hired to calculate the weighted average cost of capital for Elgoog, a software and app

Your friend Toni, a consultant for PriceEarthHouse LLP, has been hired to calculate the weighted average cost of capital for Elgoog, a software and app development company. Shares of Elgoog are currently trading at $22, and the firm has 1 billion shares outstanding. From the Wall Street Journal, the current yield-to-maturity on T-Bonds is 2%, and the market risk premium is 9.5% (these particular values are widely agreed as being the correct inputs to the CAPM). Further, based on their latest balance sheet, Elgoog has long-term debt of $10 billion (the bonds underlying this debt have 9 years until maturity, a face value of $1,000, an annual coupon of 9%, and the bonds are trading at 90% of par). The book value of common equity is $16.2 billion. Elgoogs marginal tax rate is 35%.

Toni estimates that Elgoogs beta is 0.15 and, along with the other information above, calculates the cost of equity for Elgoog using the CAPM as:

E (R) = 2% + 0.15 (9.5%) = 3.425%

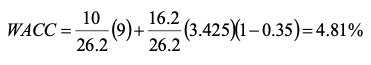

Toni then calculates Elgoogs after-tax weighted average cost of capital as 4.81% based on the following:

Identify any potential problems with Tonis approach in arriving at the WACC. If you identify an error in a calculation/input outline what calculation/input you would use as an alternative.

WACC = 10 16.2 (9)+ (3.425)1 0.35)=4.81% 26.2 26.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started