Answered step by step

Verified Expert Solution

Question

1 Approved Answer

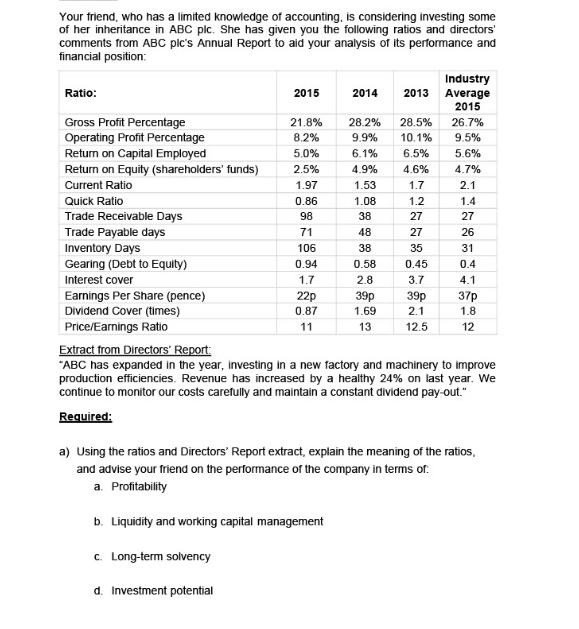

Your friend, who has a limited knowledge of accounting, is considering investing some of her inheritance in ABC plc. She has given you the

Your friend, who has a limited knowledge of accounting, is considering investing some of her inheritance in ABC plc. She has given you the following ratios and directors' comments from ABC plc's Annual Report to aid your analysis of its performance and financial position: Ratio: Gross Profit Percentage Operating Profit Percentage Return on Capital Employed Return on Equity (shareholders' funds) Current Ratio Quick Ratio Trade Receivable Days Trade Payable days Inventory Days Gearing (Debt to Equity) Interest cover Earnings Per Share (pence) Dividend Cover (times) Price/Earnings Ratio 2015 21.8% 8,2% 5.0% 2.5% 1.97 0.86 98 71 106 0.94 1.7 22p 0.87 11 c. Long-term solvency d. Investment potential 2014 b. Liquidity and working capital management 28.2% 9.9% 6.1% 4.9% 1.53 1.08 38 48 38 0.58 2.8 39p 1.69 13 2013 28.5% 10.1% 6.5% 4.6% 1.7 1.2 27 27 35 0.45 3.7 39p 2.1 12.5 Industry Average 2015 26.7% 9.5% 5.6% 4.7% 2.1 1.4 27 26 31 0.4 4.1 Extract from Directors' Report: "ABC has expanded in the year, investing in a new factory and machinery to improve production efficiencies. Revenue has increased by a healthy 24% on last year. We continue to monitor our costs carefully and maintain a constant dividend pay-out." Required: 37p 1.8 12 a) Using the ratios and Directors' Report extract, explain the meaning of the ratios, and advise your friend on the performance of the company in terms of a. Profitability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started