Question

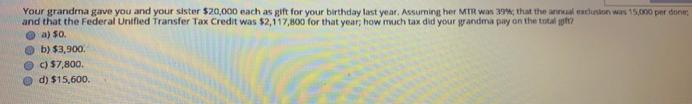

Your grandrma gave you and your sister $20,000 each as gift for your birthday last year. Assuming her MIR was 39, that the annual

Your grandrma gave you and your sister $20,000 each as gift for your birthday last year. Assuming her MIR was 39, that the annual ealusion was 15,000 per donr and that the Federal Unifled Transfer Tax Credit was $2,117,800 for that year, how uch tax did your gyandma pay on the total p? O a) $0. O b) $3,900. C) 57,800. d) $15,600.

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Unified Tax credit is a credit available for gifting money ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting concepts and applications

Authors: Albrecht Stice, Stice Swain

11th Edition

978-0538750196, 538745487, 538750197, 978-0538745482

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App