Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your have been following NetOne, a new, high-growth company. You estimate that the current risk-free rate is 3.0 percent, the market risk premium is

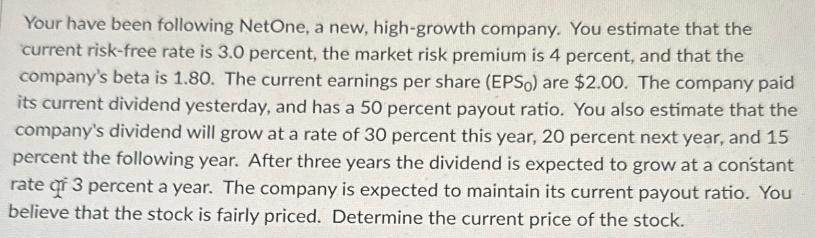

Your have been following NetOne, a new, high-growth company. You estimate that the current risk-free rate is 3.0 percent, the market risk premium is 4 percent, and that the company's beta is 1.80. The current earnings per share (EPSO) are $2.00. The company paid its current dividend yesterday, and has a 50 percent payout ratio. You also estimate that the company's dividend will grow at a rate of 30 percent this year, 20 percent next year, and 15 percent the following year. After three years the dividend is expected to grow at a constant rate of 3 percent a year. The company is expected to maintain its current payout ratio. You believe that the stock is fairly priced. Determine the current price of the stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

answer NetOne Stock Price Calculation We can use the Dividend Discount Model DDM with constant growt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started